read sva submissions

Scam Victim Alliance advocates for harm redUCtion, ideas & innovation to stop financial crime & scams

campaigns for change

-

Secure identities, end impersonation

Impersonation is too easy. Digital Trust Exchange was supposed to be live at the beginning of 2025 - hurry up!

-

End mule bank accounts

Stop Australian banks and payment platforms enabling mules bank, crypto and foreign currency exchange accounts.

-

Stop money laundering

Money laundering helps scammers turn illegal profits into "clean" money that looks legal. Stop placement and layering of scammed money leaving Australia.

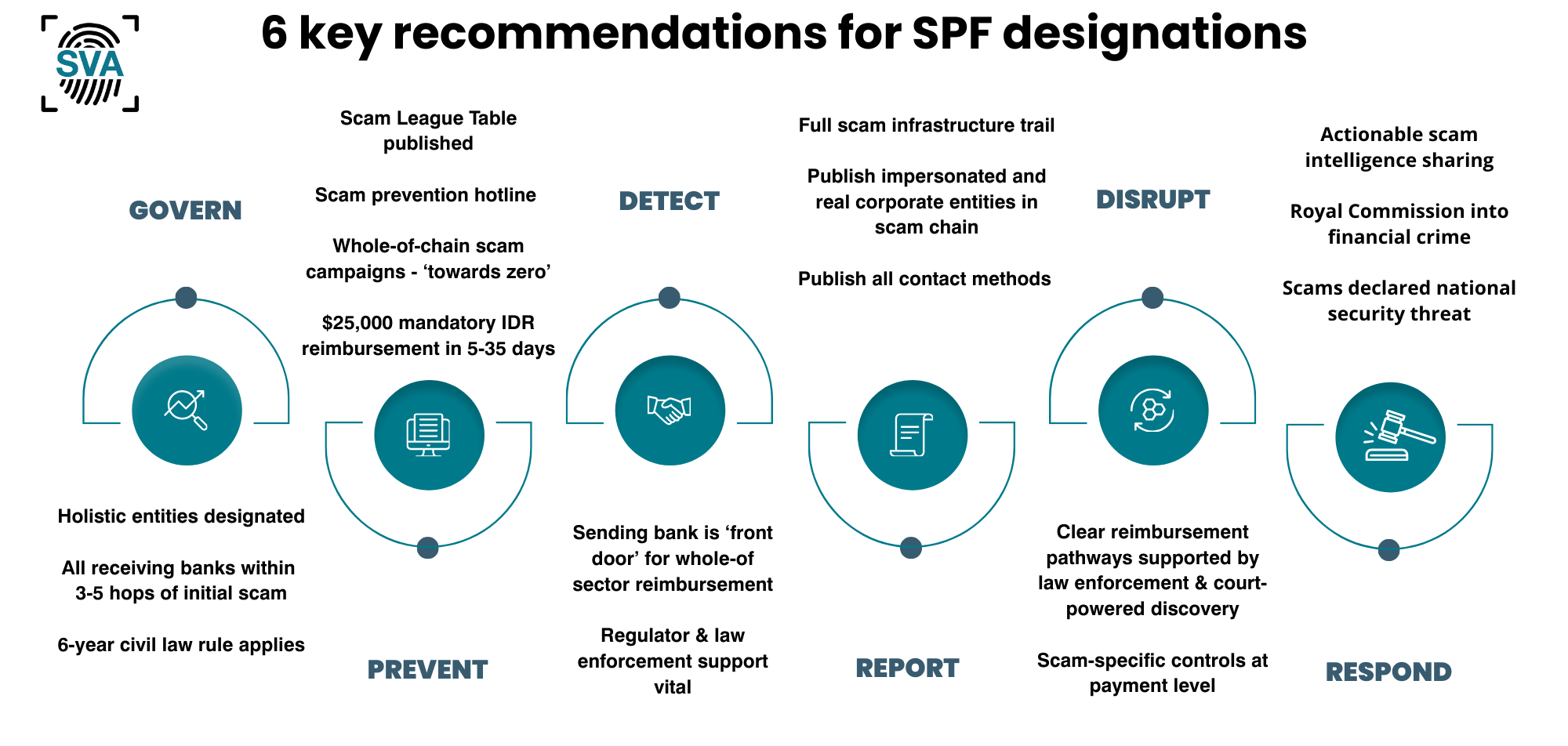

scam victim alliance advocacy

1.stop mule accounts & money laundering

Banks, regulators and law-enforcement must unite to stop the mule bank account getaway cars stealing scammed money for transnational criminal groups who identify as legitimate business people.

2. trauma-informed support for victims

From dealing with law enforcement to seeking justice from banks and the Australian Financial Complaints Authority, victims urgently need trained, trauma-informed responders to stop perpetuating the harm a cyber-enabled crime victim experiences.

3. slow down! fix bank transfers

Large transactions like term deposits, superannuation fund rollovers and home purchases used to be protected by fraud measures in the cheque system. Electronic payments have no such protections - slow them down to 48 hours!

4. an accountable money trail for victims

Financial institutions must be transparent about why they cannot recover scammed funds and stop forcing victims to fund expensive civil court ‘discovery’ processes that cost up to $30,000 to find out what happened to their stolen money. AUSTRAC need to match scammed and stolen funds with Suspicious Matter Reports so victims are assured their stolen money is not adding to the global harms of cyber-enabled crime.

5. abolish the epayment code’s ludicrous idea that victims authorise their scam

Even the Australian Financial Complaints Authority has asked the Australian Government to re-examine this code. Australia’s strong consumer laws and protections against financial harms have been undermined by the ePayments Code, which was built for a different age. The concepts of ‘mistaken payment’ and ‘authorised payment’ need urgent re-examination.

6. deception and impersonation are crimes

The crimes of identity theft, fraud, obtaining funds by deception and money laundering are embedded in state and federal crime codes, yet justice through the Australian Financial Complaints Authority ignores this. Ending deceptive practices exploited across technology, social media, telco and government-issued identity documents will help end the scourge of industrial-scale scamming.

7. names and account numbers must match

Financial institutions and payment platforms must be accountable for exact matches between names and account numbers in the same way they are when a BSB number is incorrect.