SVA Speaks out about scam prevention framework codes

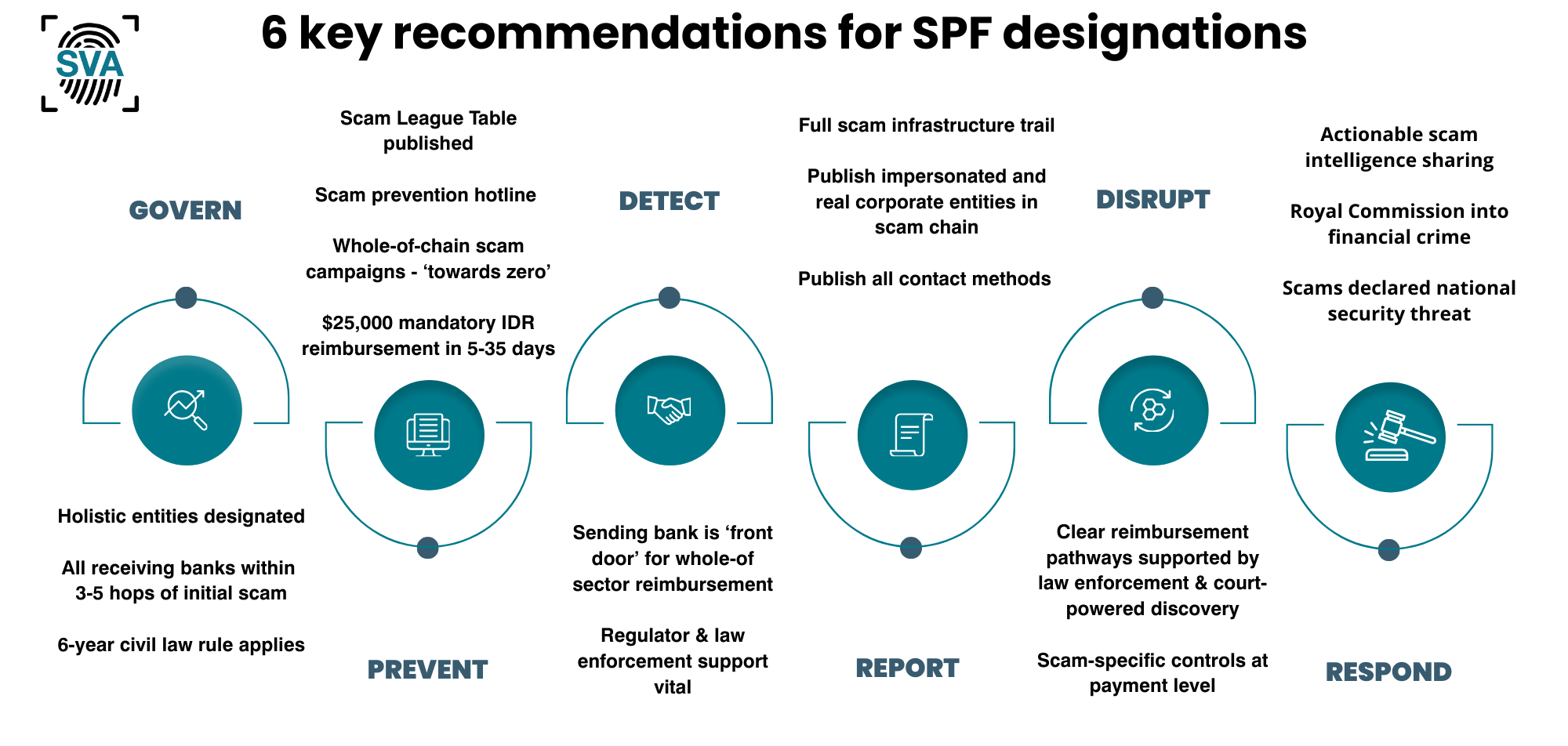

Scam Victim Alliance has 6 key recommendations to stop Australia entrenching the harm of scams in response to Treasury’s SPF codes and designations.

Scam Victim Alliance spent our Christmas holidays writing this submission to Treasury about it’s world-leading reforms to fight scams. The SPF risks becoming a framework of good intentions that will actually increase scam harms unless the Codes impose clear and enforceable obligations on regulated entities

Executive summary

Our lived experience gives us deep insight into how scammers manipulate digital payment systems — and how banks, telcos, and digital platforms have allowed their infrastructure to be weaponised. Australian corporations are unwittingly funding what Interpol has called a “global crisis” of human trafficking and other criminal harm. We welcome this opportunity to make a submission to the SPF Treasury consultation.

Scam Victim Alliance (SVA) was founded in May 2025 to support Australians devastated by scam frauds, abandoned by a system that delivers inconsistent recovery processes and untold trauma.

Scam fraud hits hardest in Australia’s most vulnerable communities—older Australians and those from culturally and linguistically diverse (CALD) backgrounds—forcing taxpayers and individuals to carry the cost of the escalating scam fraud crisis harming all nations around the globe. Australia now faces scam compounds setting up shop on its doorstep—in Timor-Leste, New Guinea, Palau and Fiji, no doubt attracted by the rich pickings of Australia’s poorly protected payments markets.

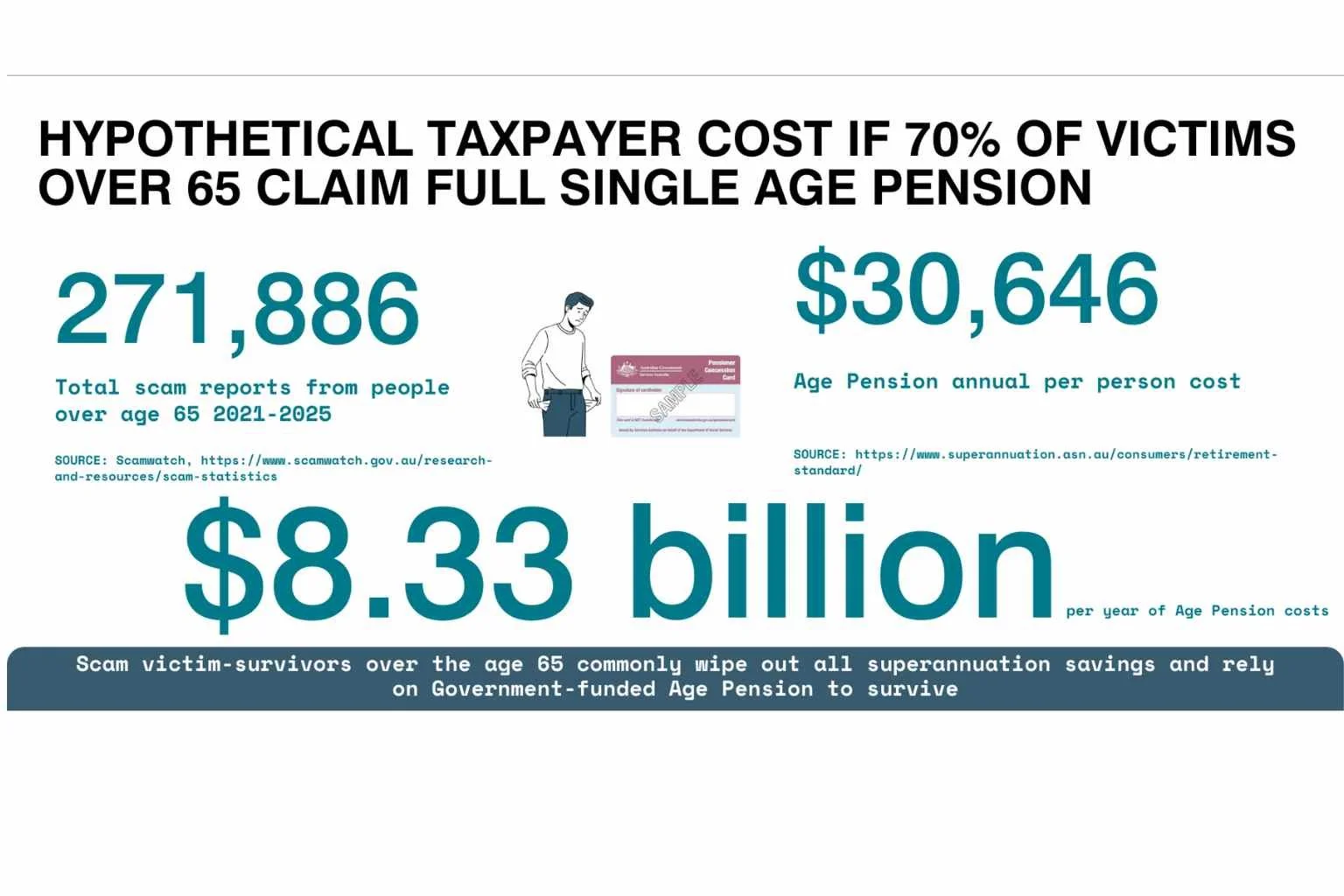

We believe that if the clear recommendations from the 2019 Banking Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry had been successfully implemented and enforced by APRA and ASIC, much of the scam-related harm experienced since 2020 could have been significantly reduced, as detailed in Appendix A. If scam losses and their downstream impacts were properly accounted for, the true cost to taxpayers would be staggering.

For example:

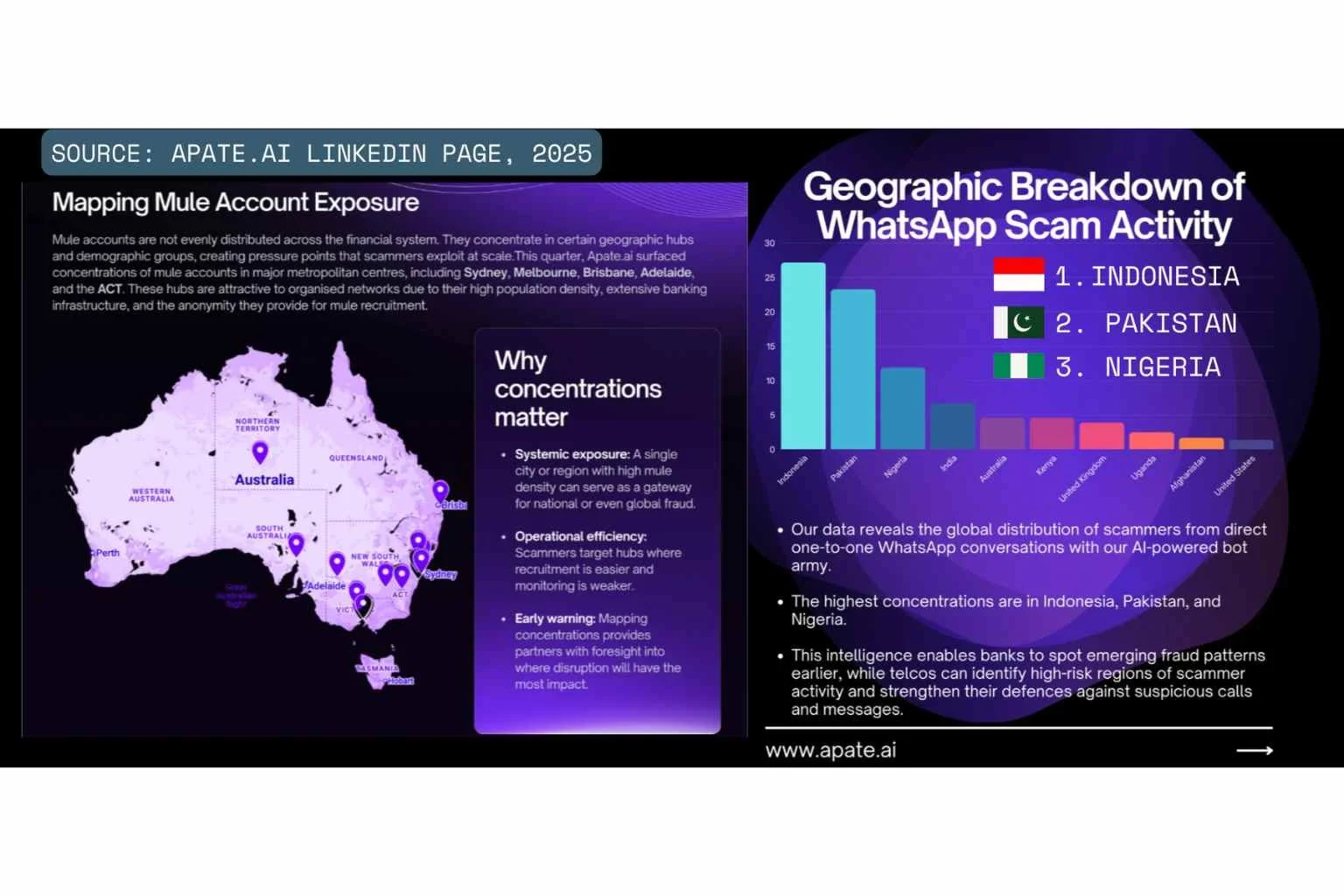

● Since 2019, 272,000 Australians over 65 have lost their superannuation to scams. If just 70% of these people had to then claim an Age Pension due to not having any superannuation, this would add an estimated $8.33 billion annually to Aged Pension costs.

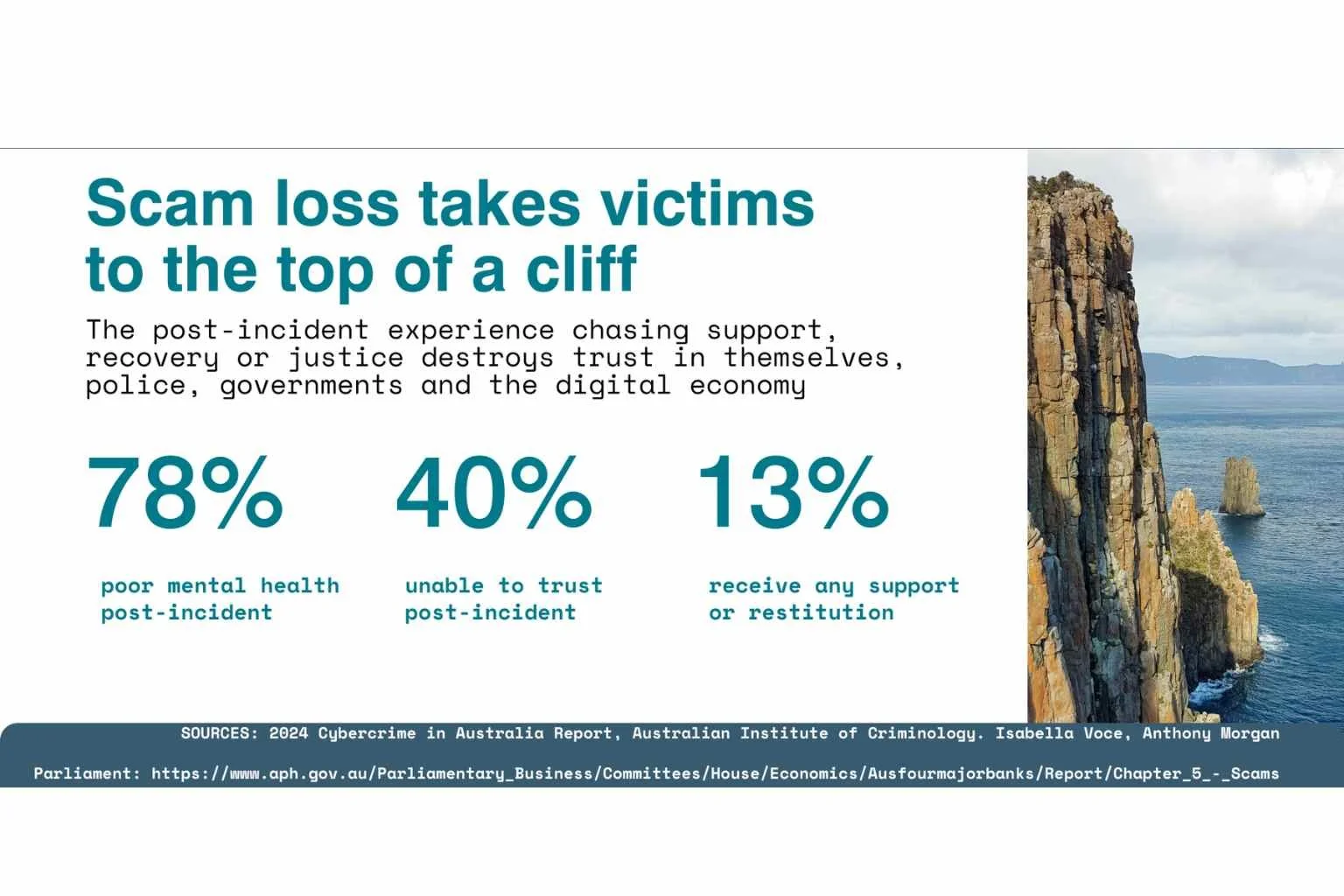

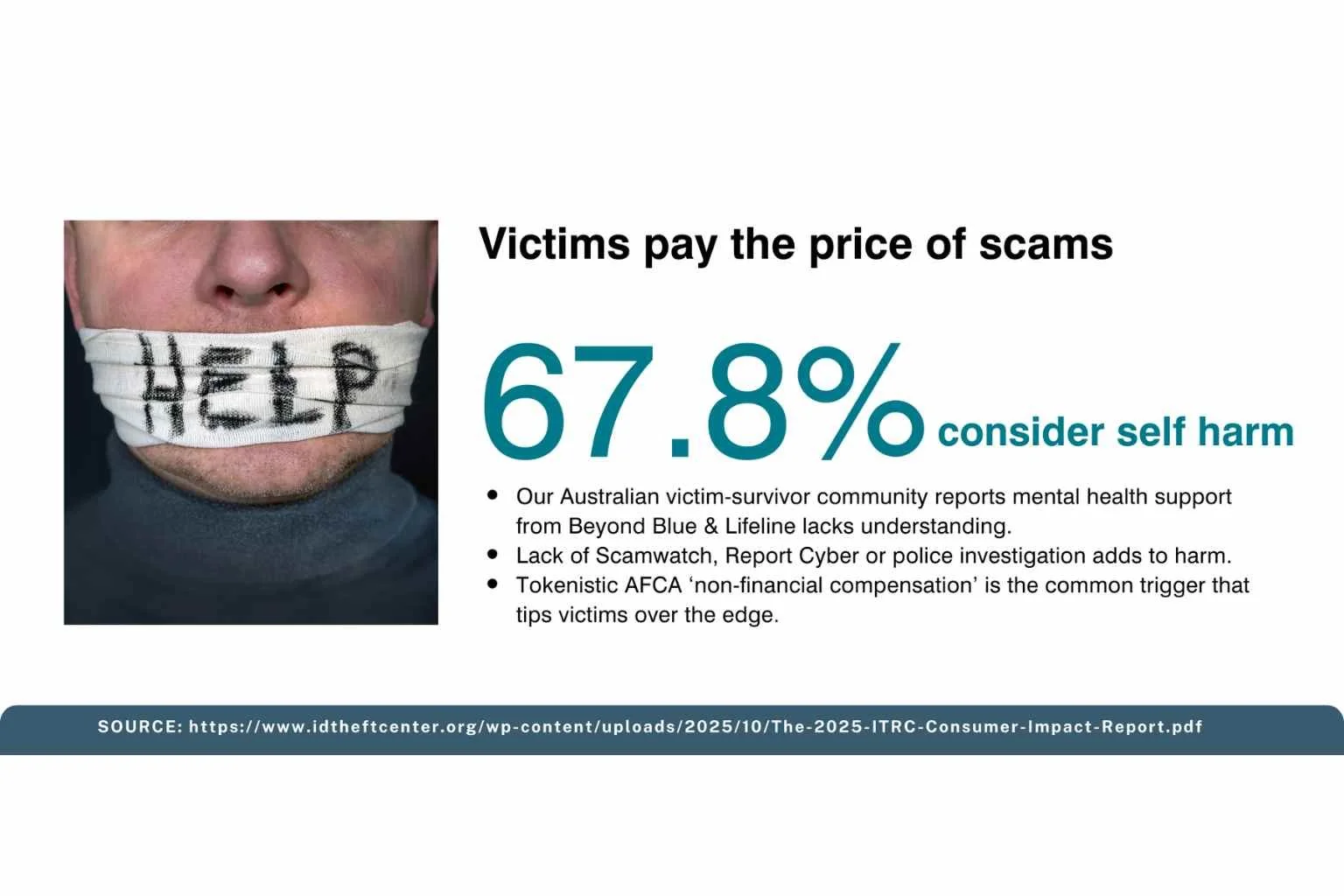

● And if just 70% of Australia’s estimated 1.25 million scam victims since 2021 required Medicare-funded psychological support, it would cost taxpayers approximately $1.24 billion in mental health care.

Our executive summary recommends key inclusions and designations to stop scams proliferating and make a genuine attempt to reimburse consumers.

These costs represent real and growing pressure on Australia’s public services, all while institutions that failed to prevent scam fraud are not held financially accountable.

In addition, we believe two critical failures have left Australians exposed to an untested legal liability that’s enabled large-scale theft from individuals through scams:

1.Banks have refused to acknowledge that their platforms and processes have been conduits for criminal fraud.

Banks have remained wilfully blind to their role in the fraud crisis, relying on the same strategies of denial used during the 2019 Royal Commission. Banks and payment platforms deflect from their facilitation of fraud (including impersonation and payer manipulation fraud) by insisting that scam losses are customers’ fault, even though banks have legal duties:

not to allow mule accounts to be established that don’t meet Know Your Customer (KYC) standards,

raise red flags for known scam patterns,

transparently recover scammed funds.

Banks spend millions marketing their “scam defences” and boasting about AI and staff investments — yet still blame customers when their own processes and failures to train staff on known scam typologies fail. Banks have ignored basic safeguards like 48-hour payment holds or MFA for high-risk transfers, such as property purchases or superannuation, and shifted the blame to customers rather than invest the paltry $100m needed to establish CoP before the fraud crisis escalated in 2020.

2. Regulators and Government failed to implement Confirmation of Payee (CoP) as part of the ePayments Code review early enough to protect Australians.

In 2019, Consumers Federation of Australia called out the lack of “meaningful sanctions to create an effective deterrent for non-compliance” in the ePayments Code, leaving Australians uniquely exposed to fraud. The ePayments Code - along with the Banking Code - are sometimes contentiously misinterpreted by an over-run External Dispute Resolution body, the Australian Financial Complaints Authority (AFCA).

In Part 2: Introduction of this submission, we outline how corporate failures have emboldened domestic fraudsters to escalate their tactics. In Part 3: Consultation questions we specifically explain the 6 key recommendations outlined in our Executive Summary below and in Part 4. Whole of ecosystem approach we offer our conclusions. Evidence for our recommendations is then provided in our Appendix items.

We welcome the draft Scam Prevention Framework (SPF) and newly published codes and designations which promised: “Victims will have clear pathways to compensation if the business fails to meet robust standards.” — Former Assistant Treasurer Stephen Jones on 13 February 2025 when he promised the SPF Codes would protect Australians and be operational from July 1 2026

Upon release of the designations from Treasury, analysis published in Australia’s leading financial newspaper stated:

“The definition of reasonable steps is rubbery enough to give the banks, telcos and social media platforms a “get out of jail free” card … Compounding that problem is the fact there will be no legally enforceable actionable scam intelligence for at least two years.” — Australian Financial Review’s Tony Boyd on 22 December 2025 about the newly released Treasury consultations and position paper this submission focuses on

SVA believes individual victims and taxpayers bear the cost of financial crime that corporations profit from. We believe the SPF designations must be significantly improved with 6 recommendations.

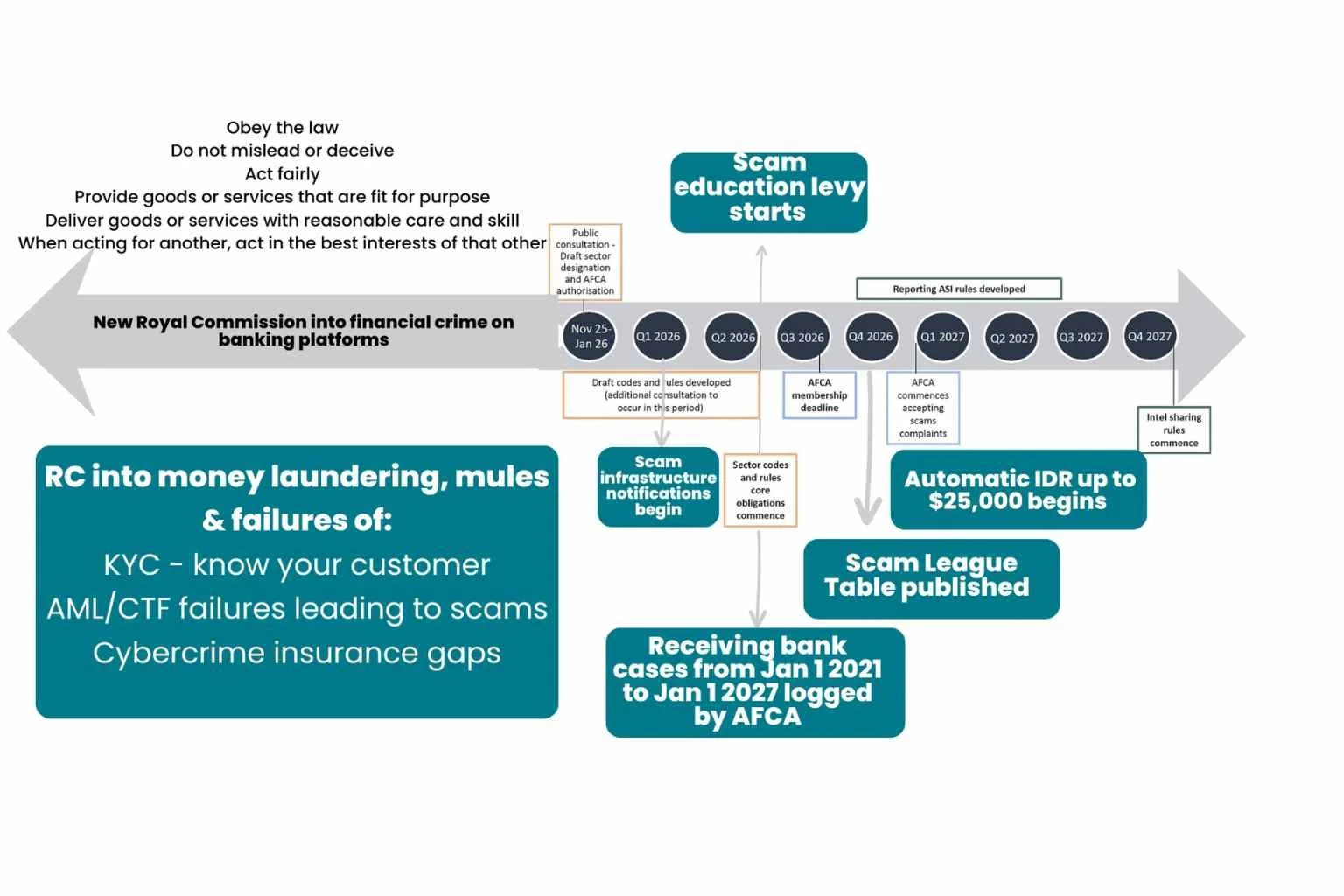

Recommendation 1. Governance works only if all entities in scam chains are designated

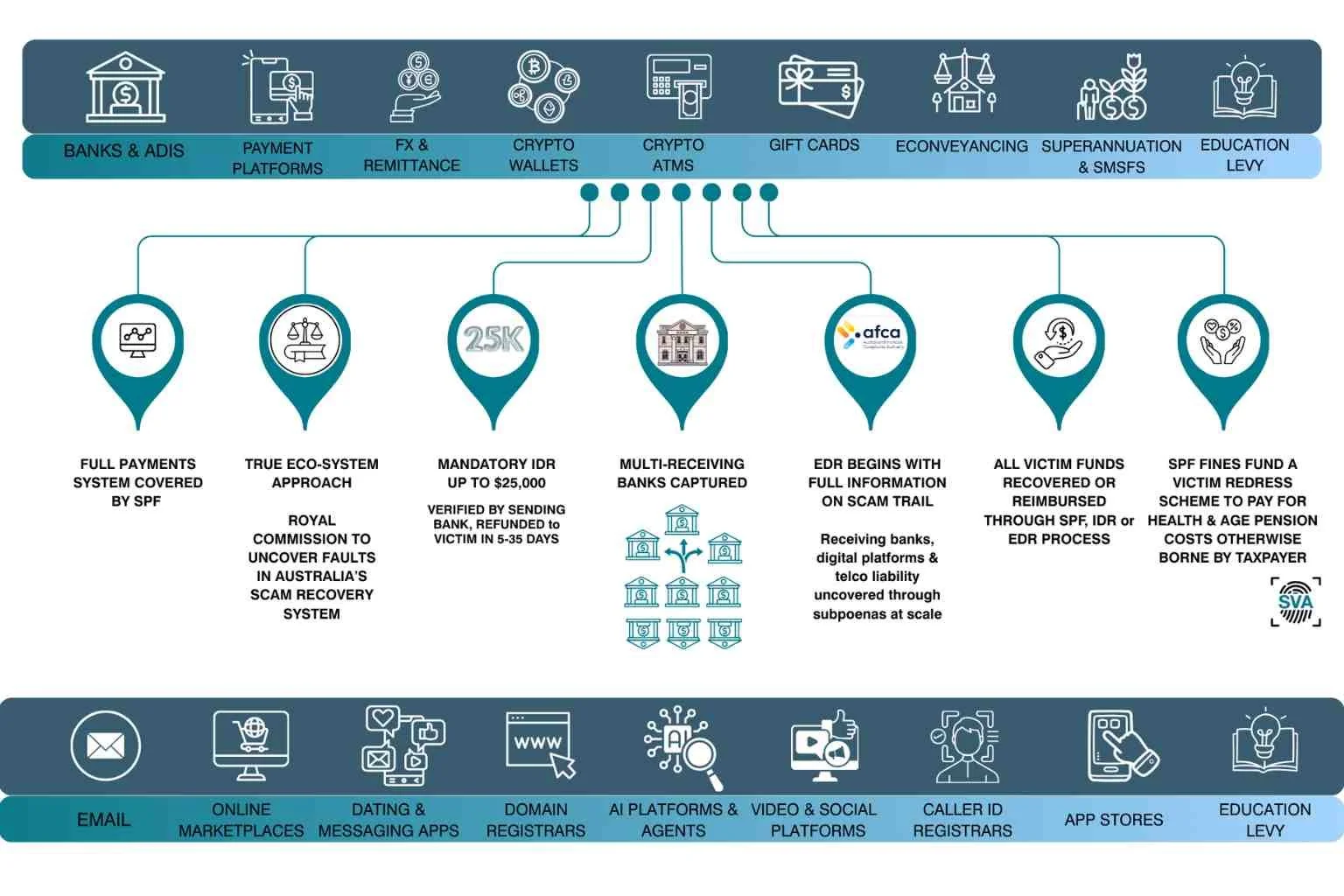

All relevant sectors must be designated under the SPF to ensure whole-of-ecosystem accountability and give the framework any chance of achieving its policy intent. This includes:

● Banking & Payments: All ADIs, non-bank remitters (especially foreign currency remitters such as Wise, Revolut or OFX), cryptocurrency exchanges and ATMs, eConveyancing platforms (PEXA and Sympli), gift card services, payment providers (BPay, PayID, Monoova, Cuscal, PayTo etc), and superannuation funds.

● Digital Platforms: Email hosts (e.g. Gmail, Outlook, Yahoo), online marketplaces (Meta, Gumtree, eBay), dating apps and platforms (Tinder, Hinge etc), domain registrars (e.g. GoDaddy, Ventra IP), Hosting platforms (e.g AWS or entities responsible for servers not serving illegal material), Caller ID registrants (e.g. Hiya), AI agents (e.g. ChatGPT, Claude, Gemini), App stores (side-loading malware is a key scam vector).

Furthermore, we believe that ASIC’s Registers and MoneySmart Investor warnings must be held to the same standard as the SPF dictates for regulated entities. Our community believes ASIC’s investor warnings have failed to keep up with known scam patterns and actively endangered people to invest in imposter and investment scams that could have been prevented through up-to-date warnings and a hotline to check for known scam types.

Additionally, an education levy should apply to designated sector ASIC registrations to fund a Safe Systems approach to scam awareness.

The SPF risks becoming a framework of good intentions that will actually increase scam harms unless the Codes impose clear and enforceable obligations on regulated entities.

The proposal for equal apportionment of scam-related compensation among institutions is problematic. Banks have historically borne the responsibility for safeguarding customer funds. Diffusing bank liability must be tied to demonstrated levels of responsibility and control failure—not arbitrarily split. Without enforceable standards and fair redress mechanisms, this framework will not only fail to protect Australians, it will entrench systemic gaps and allow industry actors to continue passing the cost of preventable fraud onto victims and taxpayers.

Recommendation 2. Prevent scams with a hotline and Scam Infrastructure League Table in advance of Actionable Scam Intelligence-sharing

A scam education campaign and consumer hotline should be funded through an ASIC levy on all SPF-designated entities or funded by proceeds of crime. Scam infrastructure reporting must begin in the first half of 2026 with the NASC publishing a Scam Infrastructure League Table, updated quarterly, listing the most misused corporate brands (including impersonations of government entities like the Australian Tax Office), mule accounts, phone numbers and scam ad, email and website tactics — with strict liability for entities failing to block repeated abuse. Consumers must be able to call a hotline to find out if they are paying a known scam account, receiving calls from a known scam number or receiving ads, emails or phone numbers from known scam compound devices or locations.

Furthermore, scam infrastructure data can already include existing intelligence like:

● Known mule accounts reported to Scamwatch, the Australian Financial Crimes Exchange, the Global Signal Exchange and state and federal law enforcement information,

● Known spoofed telephone numbers used in previous frauds investigated by ASIC,

● Known accounts flagged to AUSTRAC through SMR and TTR reports that are associated with other known scam typologies.

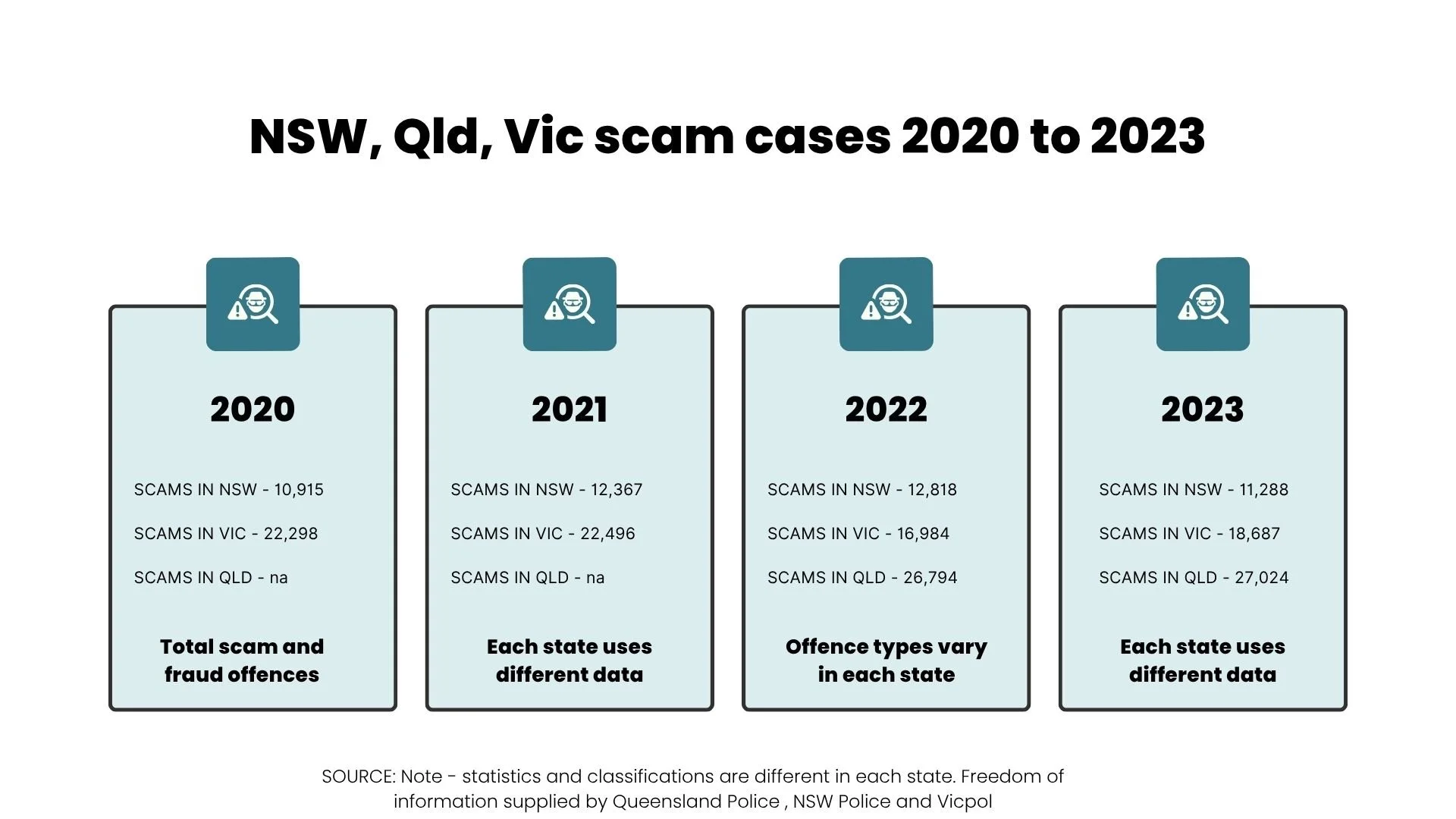

We would also contend that part of the harm to victims is not adequately measuring scam losses or how effective warnings and education campaigns are. We would also ask the Federal Government to find a better way to measure the taxpayer impost of looking after scam victims after losing life-changing amounts of money.

Recommendation 3. Detect by having sending banks as single ‘front door’ for whole-of-sector reimbursement, supported by regulators and law enforcement

Banks are best placed to act as the front door for scam reporting, verifying losses with their customers before collecting full scam infrastructure data (e.g. malicious ads, email headers, hosts of illegal content, mule accounts, fake domains, impersonated brands) to help detect patterns and trigger liability across non-bank sectors. Regulators and law enforcement would support this scam infrastructure reporting.

Recommendation 4. Report full scam payment‑trail disclosure to trigger a 5-35 day IDR reimbursement up to $25,000 with funds recovered from other SPF entities through infringement notices and court enforcement.

Banks must verify scam losses and pay up to $25,000 at IDR within 5–35 days. If a case is unresolved, regulators and law enforcement must subpoena the full scam trail - including scam infrastructure and receiving banks - before escalation to EDR or recovery from other sectors.

SVA recommends the full scam infrastructure trail must be subpoenaed quickly (ideally by day 36 after the scam report if mandatory $25,000 IDR reimbursement fails) to trigger early detection and disruption. Strict liability must apply to any entity that fails to block or shut down known scam infrastructure. All SPF fines should fund a victim redress scheme to fund ongoing reimbursement and mental health programs.

A separate ASIC scam education levy should apply to designated sectors and this education must be responsive and agile in the same way road safety campaigns and education adapts to high-risk road use trends. Education campaigns must be whole-of-sector focused and educate about corporate compliance culture, mule accounts and money laundering to prevent harm before it starts. This must include a free, language-supported telephone hotline for the public to check scam warnings and report suspicious activity — especially for vulnerable or non-digital consumers.

Recommendation 5. Disrupt by ensuring all telcos, digital platforms and banks have clear reimbursement, freezing and takedown obligations - backed by law enforcement

Fast, clear Internal Dispute Resolution (IDR) is the most effective way to stop scams in their tracks. When all designated corporations face a financial incentive—such as IDR up to $25,000 in reimbursement and larger penalties—they’ll act quickly to freeze and recover stolen funds. Fear of financial loss will displace the current wilful blindness, driving action desperately needed to protect victims and save taxpayers.

We believe a nationally co-ordinated approach like Australia has used to tackle road safety can be emulated to restore safety and trust to our digital economy, potentially by considering issues like:

Mandatory cybercrime insurance (like compulsory third-party insurance to register a car)

Fines and infringements issued by law enforcement to SPF entities (like speed camera or parking infringements - failure to pay results in heavier fines and criminal offences)

Education and targeted enforcement Additional ASIC levies on high risk SPF entities fund a scam hotline, with the National Anti-Scam Centre (NASC) publishing true and verified scam data that tells the public the truth about corporations’ role in scams — whether impersonated or genuine. We would also encourage public reporting of corporate investment in staff training around scams and month-by-month marketing spend.

Recommendation 6. Respond with a Royal Commission into financial crime with the 6-year common law protections to apply to receiving banks

A Royal Commission into financial crime, mule laundering and systemic failures is required to deliver accountability and lasting reform. SVA is concerned that the erosion of existing common law rights under the SPF (i.e. existing bank liability) is reduced from the pre-SPF 100% down to 50% or less if other SPF entities are involved, hence we demand the 6-year common law rule must apply.

We propose a Royal Commission is necessary to investigate how financial crime has infiltrated Australian financial services with so little reimbursement to consumers.

SVA Calls for a Mandated Right to Pay in Cash to stay safe in the digital economy

Scam Victim Alliance urges Treasury to maintain cash as a protected pathway for consumers to transact safely.

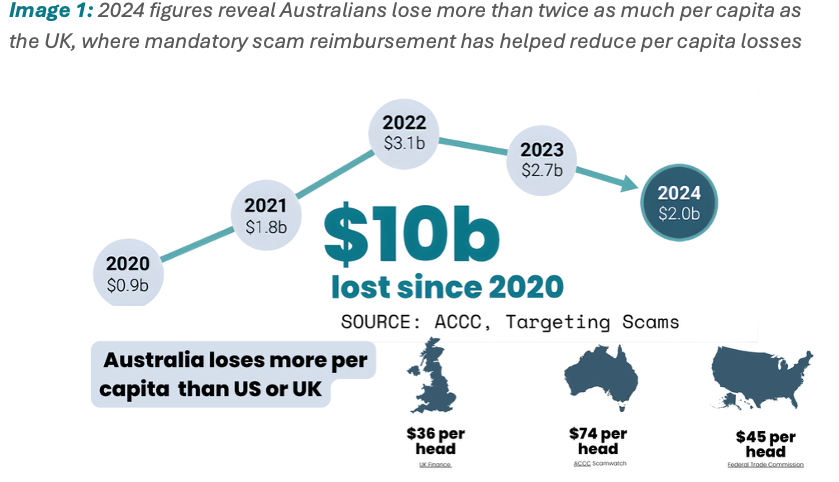

With Australians losing more per person to scams than the US or UK, Scam Victim Alliance is urging the government to preserve cash access as a basic consumer protection in a broken digital economy.

We urge Treasury to view mandated cash acceptance as a critical measure to preserve consumer rights, limit harm from financial crime and uphold economic fairness

As a national network of scam victims and harm reduction advocates, we are acutely aware of the risks of our digital economy, which continues to fail Australian consumers and expose them to financial crime.

Many of our victims were trying to open a term deposit, buy a home or move or transfer their superannuation savings when they were targeted by criminals operating with impunity across Australia’s banks, digital platforms and telcos.

We urge Treasury to view mandated cash acceptance as a critical measure to preserve consumer rights, limit harm from financial crime and uphold economic fairness.

Australia needs a resilient and inclusive economy that allows cash to be accepted for essential goods and services

Digital fraud risks must be acknowledged as a driver of financial harm, with cash and cheques the only alternative for vulnerable consumers to transact safely Australians are being actively victimised by the lack of consumer protection in the digital economy, suffering higher per capita scam losses compared to the US and UK in 2023 and in 2024.

Banks and digital platforms have shifted accountability for modern fraud on to customers, rewriting their account terms and conditions to push scam liability onto customers.

Given that most of Australia’s fraud protections existed in the Cheques Act – and that cheques are being sunsetted – the right to use cash remains vital for protection from financial harm caused by lax digital and banking controls that have seen cyber-enabled crime flourish.

Many of our community members are so traumatised by their extreme financial losses that they wish to never use digital apps or online banking again.

The ePayments Code further harms consumers by actively blaming them for falling victim to a financial crime and ‘authorising’ their own loss.

Australia’s Banking Code offers more protection for consumers transacting face to face in a bank branch rather than online, which again underlines the need for broad access to cash and cheques.

• Payment misdirection fraud is the fastest growing scam type, according to the ACCC, so access to cash is a vital consumer protection.

Telcos, banks and digital platforms allow impersonation and deception with little consequence – the Scam Prevention Framework still has no codes or rules to hold corporations to account.

Banks charge interest on financial crime losses and the Australian Financial Complaints Authority endorses this . Consumers urgently need government to step up and hold a Royal Commission into the state of financial crime and money laundering across Australia’s digital economy.

Scam Victim Alliance believes the scourge of financial crime can only be addressed when the government realises the true extent of how corrupted Australia's payments system has become.

There are regulatory loopholes, rampant money laundering and profit-seeking from legitimate and illegitimate stakeholders that effectively make authorised push payment frauds legal and highly successful.

MONEY LAUNDERING ON THE STREETS OF MELBOURNE

Hope & Tom Clifford had their $250,715 property settlement money stolen in a sophisticated fraud that was set up on Snapchat with a $5000 offer to a money mule. The mule then drove around the streets of Melbourne, laundering the $250,715 by buying a gold bar, changing it into foreign currency and withdrawing cash.

Dubbo couple Hope and Tom Clifford had their $250,715 property settlement stolen by a mule with a Commonwealth Bank Account. Court documents revealed the mule was paid $5000 by malicious actors to receive the Clifford’s misdirected funds into his personal bank account, which is still operated by the mule today.

The crime gang network had also breached the Clifford’s solicitor’s email to send a forged and misdirected Commbank payment instruction to the Cliffords.

The Cliffords then went into their local NAB branch to do the payment in person. Court documents reveal the money mule was driven around Melbourne withdrawing cash from ATMs, buying foreign currency and a $94,000 gold bar with the $250,715 proceeds, which meant no money was recoverable to the Cliffords or their bank.

The mule received just 150 hours community service, with no conviction recorded. The justice system did not force a recovery or compensation order on to the mule.

No other people were arrested. This level of on-shore money laundering reveals the need for a whole-of-society approach to fighting financial crime.

The initial misdirected payment happened inside a NAB bank branch, while NAB was engaged in an enforceable undertaking with AUSTRAC to prevent money laundering.

• Digital fraud is a daily threat, not a fringe issue In this context, cash is not just a payment method—it's a tool of financial autonomy.

It is the only payment form that cannot be hacked, reversed, profiled, or denied by an algorithm. Mandated cash acceptance is one way for consumers to avoid the cybersecurity risks of online transactions.

APRA’s stakeholder survey reveals 91 per cent of banks, insurers and super funds describe cyber risks as critical or high risk, yet consumers often have no choice but to use it.

The government's own data confirms that scam losses are rising, and digital systems are failing to prevent it.

Maintaining cash access is a practical safeguard for individuals who have been, or may become, financial crime victims.

People victimised by romance and investment fraud often have their digital financial identity compromised and become unwitting money mules — including hacked bank accounts, drained savings, and flagged bank transactions.

In the aftermath of their fraud, their online banking can be locked or put under investigation. Some of these people are also ‘debanked’ and not allowed to operate accounts again. Many are too traumatised to trust digital payment systems again.

Cash becomes romance and investment fraud victims' only safe and immediate way to:

• Regain financial control without relying on compromised accounts

• Pay for essentials like food, transport, and accommodation during recovery

• Avoid re-traumatisation from using the same digital channels where the abuse occurred

• Protect privacy and limit further surveillance or manipulation from perpetrators, especially in cases involving coercive control.

2. The cash mandate must apply to all essential goods and services

Limiting cash acceptance to fuel and groceries will exclude key essentials that people rely on to live, including:

• Medicines and pharmacy items

• Rent and housing costs

• Utilities (electricity, gas, water)

• Public transport and essential travel

• Telecommunications (phones and internet)

This is not a theoretical issue. Many Australians - especially older people, regional residents, people with disabilities, and financially excluded groups - are being left behind in the digital economy.

A narrow cash mandate creates loopholes that accelerate digital coercion and economic control by institutions, who continue to profit by turning a blind eye to financial crime on their platforms.

We urge Treasury to require cash acceptance for all essential transactions to ensure consumer protections.

IAN WILLIAMS: A CASE STUDY AS TO WHY CASH IS VITAL FOR VULNERABLE AUSTRALIANS

Pensioner Ian Williams was scammed $1300 from his Google Pay Ubank account, operated by NAB.

His bank – and the Australian Financial Complaints Authority - blamed him for the fraud, even though he had CCTV footage showing criminals buying gift cards with his card, more than 100km from where he was located at the time of the payment.

Ian has been in a two-year+ fight self-representing himself at court to seek justice. His health has suffered.

As a consequence of the trauma and financial cost, he now refuses to transact digitally. He relies on cash to participate in the economy.

“My money is not safe in the bank, and if there is an issue, I will be blamed. If I have cash on me, I have control of it," he says.

“In the bank I have no control over my transactions, no security, no support.”

Ian contends the bank has still not given an adequate reason as to how his $1300 was taken from his account, only accusing him of being responsible for it.

3. The $500 cash limit is unreasonably low if we want to be prepared for natural disasters or cyber outages

Many essential costs exceed $500, including:

• Rental bond payments

• Quarterly utility bills

• Essential car repairs

• Bulk groceries or fuel purchases for remote travel

A $500 ceiling effectively blocks consumers from using cash in situations where it matters most.

If there is concern about abuse (e.g. large-scale money laundering), exceptions can be carved out — but the default must support high-value essential cash payments, with monitoring.

This is the approach Minister Tony Burke has outlined for monitoring crypto ATMs .

Reserve Bank Governor Michelle Bullock has acknowledged how essential cash is – even though just 10 per cent of economic transactions are done with it – and confirms that it must be available as a back up when digital systems are unavailable (such as in a natural disaster, digital outages or a cyber attack on vital infrastructure).

4. Retailer cash exemption pathways are too wide

The current proposal seems to allow the ACCC to exempt entire retail chains or site classes from holding cash.

It also exempts all businesses under $10 million turnover, including many mid-sized regional retailers. In practice, this means a regional town may have zero cash acceptance points for essentials, even where local demand is strong.

The proposed regulatory design prioritises operational comfort for retailers over the public interest.

We recommend:

• Narrowing the small business exemption to <$1 million turnover

• Requiring transparent public reporting of all exemptions granted by the ACCC.

Cash acceptance cannot become optional based on the subjective operational preferences of corporations.

5. Supermarkets and large chains must maintain meaningful cash capacity

While we welcome the "reasonable opportunity" language in the draft, it is vague and easily undermined in practice.

We already hear from victims who face:

• Long queues at the only staffed register

• "Card-only" signage at self-checkouts

• Staff discouraging cash through misinformation or passive barriers

To avoid these abuses, we recommend:

• Requiring at least 50% of payment terminals at large retailers to accept cash

• Prohibiting signage that discourages or misrepresents cash acceptance

• Mandating staff training to support compliance with money laundering laws

Cash acceptance must be functional and practical, not just technically present.

6. The cash mandate must be monitored and enforced

Regulation without enforcement invites exploitation.

Treasury must ensure:

• Clear reporting obligations for retailers

• A consumer complaint mechanism for breaches

• Published penalties and compliance data to build trust

The proposed 6-month grace period should be shortened or phased with public progress reporting to ensure momentum is not lost.

The right to use cash must not be quietly eroded through neglect, loopholes, or economic exclusion.

If Australians cannot rely on digital systems to protect them — and current scam statistics show they cannot — then the government must protect the option to pay safely with cash.

We urge Treasury to strengthen the draft regulations by:

• Expanding the mandate to all essentials

• Lifting the cash transaction ceiling

• Tightening exemptions

• Enforcing real-world compliance

• Releasing the codes and rules that support the Scam Prevention Framework

We urge the federal government and its regulated agencies to work harder with financial institutions and groups such as ours to stamp out blatant money laundering and financial crime across the Australian system.

Digital dependence does not deliver economic resilience or justice.

Cash is one pathway for consumers to remain protected while transacting in the economy given the appalling lack of consumer protections for people being robbed through their bank accounts in Australia.

The Scam Victim Alliance stands ready to work with government to protect the economic dignity and security of all Australians.

Scam Survivors Urge Lawmakers to Close Loopholes in Australia’s Crypto Bill

Scam Victim Alliance urges Treasury to mandate reimbursement, fund asset recovery, and expand crypto regulation, warning that reform without restitution fails victims and emboldens financial criminals.

Scam Victim Alliance urges Treasury to mandate reimbursement, fund asset recovery, and expand crypto regulation, warning that reform without restitution fails victims and emboldens financial criminals.

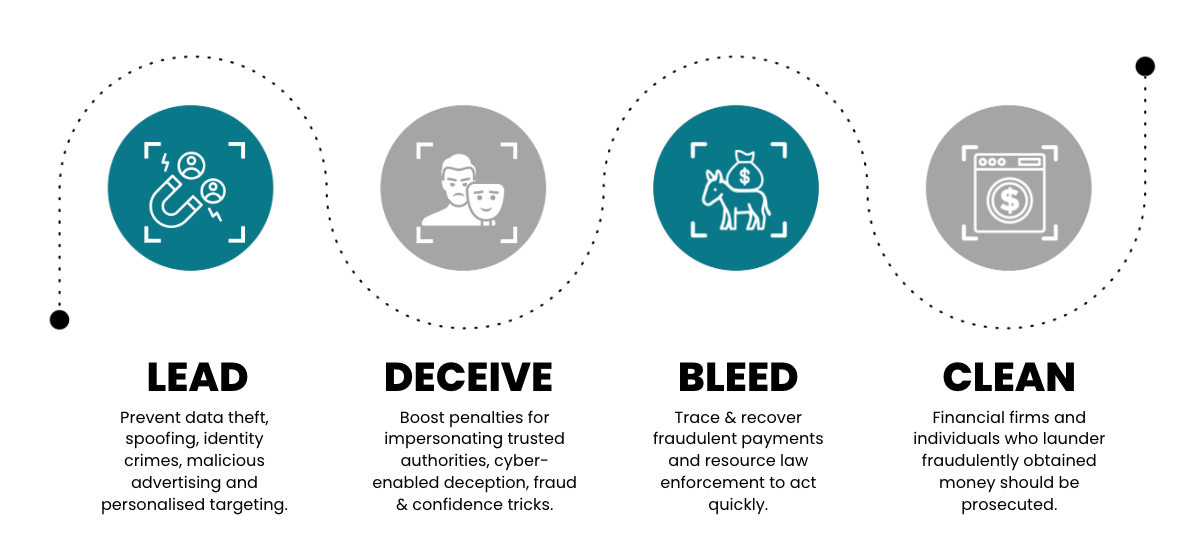

All scams - whether they relate to crypto or not - follow these four patterns.

Submission: Feedback on the Treasury Laws Amendment (Regulating Digital Asset, and Tokenised Custody, Platforms) Bill 2025

Scam Victim Alliance a group of cyber-enabled fraud and money laundering victims with lived experience of the harm that Australia’s financial system unwittingly inflicts on everyday Australians trying to pay, transact or invest in assets to secure their future.

We welcome the Australian Government’s initiative to modernise the regulatory framework for digital asset platforms and tokenised custody platforms, as set out in the Exposure Draft Bill, Explanatory Memorandum, Fact Sheet, and Consultation Questions.

The policy intent - to enhance consumer protection, close regulatory gaps, and align with international “same activity, same risk, same regulation” principles - is sound. However, we draw attention to glaring omissions in consumer restitution and recovery of lost or stolen digital assets.

1. Regulation Must Include Protection and Reimbursement

If the government wants to regulate digital assets as financial products, it must also ensure these assets have the same regulatory protection as money and securities in the traditional financial system.

While the Bill applies general obligations to licensees (such as acting efficiently, honestly, and fairly, and maintaining adequate compensation arrangements), this does not go far enough.

A reimbursement and recovery mechanism must be explicitly included in the law, especially for retail consumers who suffer loss due to:

• cyber-enabled deception that deceives retail end users;

• platform insolvency,

• fraud and theft,

• operational failure or hacking, or

• negligence, theft or fraud by licensed intermediaries.

Regulation without restitution will leave consumers unprotected in the very situations that prompted this reform.

The history of banking regulation in Australia shows that without mandatory reimbursement (for example, when victims of authorised push payment fraud are left uncompensated), institutions will always prioritise commercial interest over consumer recovery.

The Australian Payments System Review in 2021 rightly pointed out how rife fraud, trickery and deception is amongst tokens, digital asset platforms and tokenized custody platforms and it’s our lived experience that this has escalated dramatically since 2021.

We regularly hear horrific stories of harm where people believe they are ‘investing’ or ‘trading’ only to have their life savings hijacked by financial criminals. These victims are then commonly de-banked by the traditional financial system, losing access to the vital accounts needed to rebuild and recover after such devastating experiences.

Financial crime is a complex global issue which we believe can be more effectively tackled domestically by improving law enforcement and regulatory outcomes across four main pillars.

2. The Government and Law Enforcement Must Leverage Crypto Traceability Tools and Law Enforcement Must Be Resourced to Recover Assets from Overseas

Unlike fiat or traditional money, digital assets are inherently traceable.

Modern blockchain forensics tools allow rapid identification of wallet addresses, asset movement, and ownership patterns. The government should therefore:

• establish a dedicated crypto tracing and recovery taskforce jointly operated by Treasury, ASIC, AUSTRAC, and the AFP with adequate resourcing to fund international recovery;

• empower regulated exchanges and wallet providers to comply with asset-freezing and restitution orders; and

• require reporting and cooperation frameworks between exchanges and law enforcement.

This would ensure that regulation does not merely impose compliance costs but also provides meaningful remedies for victims. Like the way Australian Financial Complaints Authority funding works, these protections could be funded by levies on larger financial firm profits rather than a direct levy on a flourishing startup industry. The funding could also be tied to the loss amounts sending financial firms lose to financial crime each year, ensuring that the firms with the most power to reduce crime invest to prevent it.

3. Protection Must Extend Beyond Centralised Exchanges

The consultation papers correctly note that major losses have occurred because custodial intermediaries hold assets without adequate segregation or protection.

However, the regulatory perimeter should also consider:

• Hot and cold wallet storage (both institutional and private),

• Tokenised asset custody outside exchange environments,

• Decentralised or hybrid custodial services, and

• Cross-border platforms that service Australian consumers but operate offshore.

Without addressing these, consumer protections will remain incomplete and inconsistent.

We also believe the issue of crypto ATM machines in publicly available areas needs to be examined, as these can become hotspots for financial crime victims being duped and deceived into becoming unwitting money mules.

We support Treasury and law enforcement actions to scrutinise the cash-to-crypto and deception-to-crime pipelines to actively prevent financial crime being committed on Australian territory. We believe financial crime can be more easily thwarted by focussing law enforcement efforts

4. A Statutory Consumer Reimbursement Scheme

A reimbursement mechanism, similar to the UK’s mandatory fraud reimbursement scheme should be established for digital asset transactions.

This scheme should:

• require regulated platforms to contribute to a consumer protection fund,

• guarantee reimbursement to small business and consumers for verified cases of loss due to platform failure or unauthorised transactions, and

• ensure rapid resolution through AFCA or a new equivalent statutory body, such as a Payment Systems Regulator.

This would close the gap between financial regulation and consumer outcomes, ensuring the regime truly delivers “same risk, same protection.”

Banks refused to help, Australian crypto platform did. Consumer-centric reform that reimburses

Australia should support a globally competitive tokenised custody and digital asset platform industry. This vision will not be realised if the sector is dominated by a handful of established financial institutions that suppress innovation to develop secure and decentralised financial services.

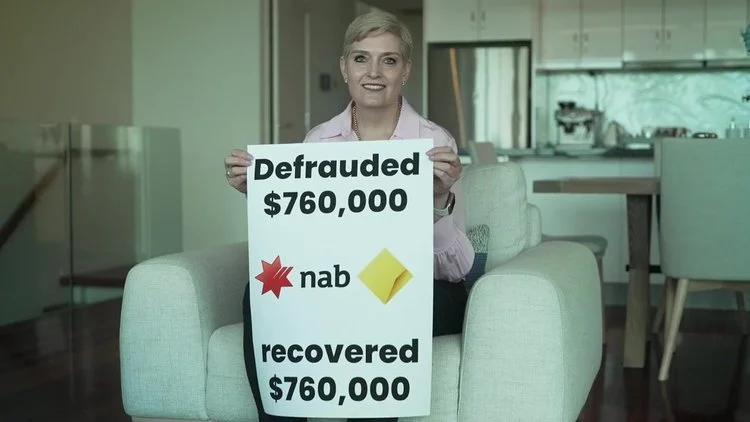

While we support major banks taking action to limit high-risk crypto transactions under the banner of consumer protection , we must also call out the double standard evident in the case of Scam Victim Alliance supporter Jacomi Du Preez , who lost $760,000 to a sophisticated bank impersonation fraud.

Jacomi had received a life insurance payout following the death of her husband and sought to place the funds in a term deposit. She approached both Commonwealth Bank and National Australia Bank, asking them to verify the legitimacy of the Macquarie Bank term deposit platform she was directed to. Both banks declined, telling her it was her own responsibility.

After realising she had been scammed, Jacomi contacted a friend in Treasury, which helped trace the funds from the banks to various recipients. She was not provided with visibility into who controlled the platforms that received her money, but she independently contacted the platforms to report the fraud.

In a remarkable act of integrity, Elbaite, an Australian digital asset platform that held a portion of the stolen funds, returned the money after Jacomi reached out. According to her, CEO Morty Tollo personally responded and refunded the full amount without delay.

As a survivor-led organisation, we commend Elbaite’s victim-first response, which stands in stark contrast to the lack of proactive support from major banks. This case illustrates that emerging digital platforms can, and do, demonstrate leadership in protecting consumers—often better than traditional financial institutions.

We urge regulators to ensure that all participants in the financial ecosystem are held to the same standards, and that the regulatory environment fosters innovation, fairness, and accountability—not protectionism.

Consumer outcomes must be the primary focus. Regulatory frameworks should not serve to entrench monopolies or prioritise the interests of powerful lobby groups at the expense of safer, more innovative solutions.

Every financial crime victim deserves to know:

• Where their money went,

• Which platforms received it, and

• For law enforcement to pursue the offenders

• For law enforcement to be incentivised to respond to these crimes by allowing them fast access to the required transaction information and strong enough laws to prosecute offenders.

We strongly support increased funding for law enforcement to trace and recover stolen funds and digital assets—no matter the platform or jurisdiction involved.

5. Alignment with the Original Intent of Digital Assets

It is important to recognise that the purpose of cryptocurrencies and digital assets was to decentralise financial control and reduce dependence on traditional banks and governments.

If the government seeks to regulate this space, it must do so without replicating the same systemic failures seen in banking—particularly the lack of accountability for consumer loss and slow response to fraud.

We believe the government has a responsibility to fund law enforcement – or law reform – to strengthen that ability to control individuals, digital asset platforms and financial firms in Australian territories who:

• Perpetrate or encourage others to perpetrate cyber-deception, impersonation, identity crimes, privacy breaches, email theft, mail theft, spoofing and other pre-transaction financial crimes

• Recruit money mules and commit identity fraud, spoofing, digital deception and other acts that lay the groundwork for modern push payment fraud

• Fail to release timely information to law enforcement when a crime has been reported.

Summary of SVA Recommendations

1. Include a statutory reimbursement and recovery framework within the Bill for losses incurred through licensed platforms.

2. Establish a national crypto asset recovery and trace unit within Treasury/ASIC/AUSTRAC which is funded to pursue active recovery of assets.

3. Mandate cooperation between regulated exchanges, custodians, and law enforcement for tracing and restitution.

4. Expand coverage to include hot/cold wallets and cross-border custody arrangements.

5. Ensure retail consumer protection parity with traditional finance.

6. Examine cheap and effective ways to bolster law enforcement’s ability to respond to financial crime.

7. Look at the issue of ‘de-banking’ crypto-related financial crime victims from traditional financial firms like banks – strengthen the chain of custody on payments to eradicate crime and identify perpetrators.

The proposed framework is a crucial step forward. However, to build public trust and deliver true consumer safety, regulation must come with protection.

Australians must not face the same gaps in accountability and restitution that currently exist in the banking system.

Thank you for considering our submission.

Sincerely,

Harriet Spring

President

Survivors Call for Fraud-Proof Payment Reform

The Scam Victim Alliance submission to the Reserve Bank

Scam Victim Alliance (SVA) is a not-for-profit organization of survivors with lived experience of scams and cyber-enabled fraud. We welcome the opportunity to provide this submission to the Reserve Bank’s (RBA’s) call for submissions2 on Merchant Card payment costs and surcharging.

We believe Australia’s payment system must be safe by design and come at as little cost as possible to consumers, who drive the engine of our economy. Fraud in instant payments is 10x higher3 than regular credit transfers and despite claims by card schemes they are ‘secure’, PayDay News reports payment fraud as a $1b problem4.

Cyber-enabled deceptions are rampant across payment systems with victims increasingly being deceived into initiating payment. We urge the Reserve Bank to consider this rising fraud problem – particularly business email compromise and ghost tapping issues – as it considers submissions for card payments and surcharging.

Efficiency and competition in payments must not come at the cost of consumer vulnerability to global transnational scamming. Interpol has called financial crime a global crisis5. We believe Australia is losing more per capita than comparable nations ($74 per head in 2024 compared to the UK’s $36 per head) to deception and organised scams. We ask the RBA to be aware that Australia's payment and financial systems need industry regulation and controls to stop this scourge. Right now, corporations deny all liability and make victims bear the cost. This is not acceptable when people pay surcharges to participate in the digital payments system.

Surge in card-not-present payments: GHOST TAPPING & OTHER FRAUD MUST BE ADDRESSED

A payment type of high concern is ‘ghost tapping’6, where Google Pay and Apply Wallets are mysteriously used by fraudsters. Financial institutions and the Australian Financial Complaints Authority lay the blame for these frauds at the consumer, who do deliver informed consent to these transactions, yet wear the cost.

A community member with a Commonwealth Bank-linked Google Pay wallet experienced more than 20 fraudulent payments, 5 card replacements and losses greater than $10,000. He was never told how the compromise occurred, only that “he released the codes and authorised the payments”. No evidence was provided by his bank, yet determination 12-00-1102187 makes him liable.

Another community member Ian Williams7i experienced the same Google Pay issue, yet had police evidence to prove other criminals made the transactions that his bank NAB said he authorised. He has represented himself in court to fight this matter to hold powerful corporations to account.

We support the RBA’s reform direction and request a focus on real-time fraud risks, safety transparency, and shared accountability across all actors in the payments ecosystem to better manage fraud.

Surcharging can serve as a friction point that prompts consumers to pause and verify the payment process, which is a crucial safety feature in digital payment environments.

SVA urges the RBA to weigh payment safety as an equal pillar alongside competition and efficiency. Simpler, safer, and more transparent payment processes and costs should be prioritised for consumers, including things like:

First-time payment holds (enabling fraudulent payments to be easily recalled)

Certain high risk payments such as superannnuation, property or purchases for large items like cars or renovations should have risk scoring and opt-in payment delays.

We believe innovation in fraud protection must be a consideration in any regulation to ensure fast-changing payment frauds can be disrupted by industry, who should bear the cost rather than push liability on to consumers.

We ask that any savings from payment surcharges are reinvested into consumer safety mechanisms, such as those listed above. We support any move that shifts incentives toward fraud prevention and helps institutions and payment providers make the digital economy safer.

We would also suggest global payment giants be required to align with Australian standards and participate in domestic scam prevention data sharing. We support phased implementation to reforms, but strongly urge scam mitigation measures be fast-tracked given the extent of losses being experienced by Australians.

Consumers deserve to know how their payment service providers rank in preventing scams and believe they should be required to report scam incident rates, funds recovered and risk mitigation practices.

We would like financial payment providers – or government – to develop an industry-wide Payment Safety Scorecard, similar to energy efficiency ratings, that genuinely help consumers reward corporations and payment providers that prevent financial crime and scams.

In conclusion, we would like to see Australia's payment systems do more to protect consumers from scams and financial crime. While innovations like real-time payments offer convenience, they also accelerate the fraud cycle, leaving victims little recourse. Scam Victim Alliance (SVA) welcomes the Safety by Design (SbD) principles outlined in AusPayNet’s July 2025 report, and we urge regulators and industry stakeholders to consider mandatory frameworks to protect people.

The transformation of Australia’s payment infrastructure must be built on trust, safety, and accountability. Technology has enabled sophisticated scams; now, it must be used to stop them. Survivor-led design, embedded safety features, and system-wide transparency can prevent life-altering financial losses. We welcome the opportunity for ongoing open dialogue and look forward to constructive reform to reduce the harm Australian scam victims experience.

Economic reform roundtable submission

The Scam Victim Alliance advocates for 5 key reforms to reduce the financial and emotional harm experienced by Australians who fall victim to cyber-enabled deceptions and crime.

Financial crime is a severe handbrake on productivity

The Scam Victim Alliance (SVA) is a not-for-profit community of survivors of cyber-enabled fraud and scams. We welcome any chance to contribute to the Economic Reform Roundtable and urge the federal government to consider the deep damage that scams and fraud inflict on financial wellness and productivity. Australia reported scam losses per capita were more than double those of the United Kingdom in 2024 and higher again in 2023.

Behind each statistic is a person, who commonly experiences shame, humiliation and long-term financial distress. Australian scam victims receive between 2 to 5% reimbursement, which increases marginally to 10% if victims complain to the Australian Financial Complaints Authority, where they undergo significantly elevated harm and are blamed for their scam.

Interpol, Amnesty and Operation Shamrock explain that transnational crime syndicates are behind the escalation in financial crime around the world. In 2023, scams took 0.11% of Australia’s GDP in reported losses. One UK fraud expert told our group “Australia is the number one fraud target in the world”, with professional scam compounds increasing the desks they devote to scamming Australians, who are considered trusting and wealthy by global standards.

Every scam - whether romance, investment, phishing, SMS or otherwise - depends on two key enablers:

1. The deception or impersonation of a trusted entity (or entities);

and

2. Money laundering to rinse the origin of scammed funds ‘clean’ to avoid being recovered by law enforcement or financial institutions.

None of this is in the national interest. Ignoring the epidemic of global scamming is not fiscally responsible in a cost-of-living crisis. Nor does it strengthen Australia’s budget sustainability. And with the rapidly increasing sophistication of Artificial Intelligence (AI), the situation will likely worsen without urgent legislation and regulatory changes.

Considering this, we offer the following recommendations for meaningful reform. Every Australian age group - from young to old – loses large amounts of money to scams. As a group with lived experience of navigating Australia’s broken system, we propose:

1. Government-led digital identity

Australia urgently needs a national digital identity framework that is resilient to fraud and impervious to criminal misuse. Public trust in government agencies and institutions is eroded when identities on banks, social media, email, the open web, telecom messages and calls can be impersonated with ease. Edelman’s 2025 Trust Barometer reveals Australians’ trust in governments and institutions is currently at an all-time low.

2. Create an economy-wide KYC Framework and better privacy

Know Your Customer (KYC) processes must be unified across banks, telcos, digital platforms, and financial service providers. Current fragmentation fuels risk and asks people to share their data across multiple platforms. Australia’s largest corporations have breached personal data - from Qantas to Medibank to Optus - and scammers wash the leaked data together to build profiles that are then targeted for scams and frauds.

3. Criminalise money laundering as integral to fraud-fighting

Fraud and money laundering are inseparable crimes. Stronger enforcement and clarity in law -mirroring reforms proposed under the AML/CTF regime - are essential to prevent stolen funds from flowing from Automatic Teller Machines into foreign currency, gold bars, crypto ATMs and other onshore and offshore ‘placement and layering’. State and federal law enforcement must have more power to use criminal justice laws. We also recommend increased transparency for scam victims to learn whether their stolen money is funding the crimes against humanity seen in overseas-based scam compounds.

4. Reform regulatory and law enforcement capacity

Australia’s current regulatory frameworks have failed to keep pace with cyber-enabled financial crime. Nationally harmonised laws - like the Australian Consumer Law - could empower agencies to act faster, more consistently, and at lower cost to taxpayers. We need to simplify the state-funded burdens these crimes are putting on our taxpayer-funded resources, which are currently inadequate and unsuccessful at delivering justice or restitution.

5. Require cybercrime insurance as a condition of housing incentives

The horrifying rise of real estate and home buyer scams, particularly through Business Email Compromise, demands immediate response. No financial institution offering federally subsidised housing loans should be allowed to operate without insuring consumers against cyber fraud. Many banks are profiting by charging interest on scammed losses and will have no incentive to change without government action.

6. Fund trauma-informed support for scam victims

The human cost of scams is not just financial. Dedicated mental health and trauma support services must be made available - beyond Medicare - to help victims recover and re-engage with the economy. We have many victims who can no longer function the way they once did. The scam is the first problem - it’s navigating justice (or the lack of it) and the devastating financial consequences that most victims report as debilitating.

7. Cut through the red tape nightmare to improve Scam Prevention Framework

While the proposed Scam Prevention Framework is a step in the right direction, in its current form it risks creating a bureaucratic nightmare - overburdening government agencies and traumatising victims, and clogging up courts with costly, time-consuming disputes.

Instead, the framework should be reworked to adopt key elements of the UK’s reimbursement model, which shifts responsibility onto the private sector - where the capacity and incentives to drive efficient, innovative solutions already exist. In the UK, this has reduced fraud by comparison to other wealthy scam-targeted countries. Mandatory reimbursement has not created the ‘honeypot’ that lobby groups have falsely claimed.

Rather than layering-on complex regulation that still forces justice on a case-by-case basis which is difficult and expensive to enforce, we need a smarter approach. We need banks, telcos and platforms to do better, not just the bare minimum. A well-designed “carrot and stick” model would encourage these industries to invest in fraud prevention and customer protection, rather than the current regime that encourages a race to the bottom with AFCA trying to pick up the pieces of each individual case.

Scams are a hidden productivity crisis

Scams are not just a consumer protection issue; they are an economic emergency. Scamwatch reported $2 billion in losses in 2024, with Consumer Action Law Centre saying 30% of victims do not report their losses. We believe the under-reporting is much higher. Scammed money could be better utilised to invest in homes, businesses, and community life.

As more Australians are defrauded, money is siphoned offshore, often into the hands of international crime syndicates. This weakens our tax base, limits our ability to fund services, and undermines long-term productivity.

The UK has acknowledged this. Its Attorney General recently argued that fighting fraud is essential “to kickstart economic growth.” Australia must do the same.

Addressing scams by improving identity systems, harmonising enforcement, and protecting victims will rebuild public trust and immediately enhance productivity. Every dollar that stays in our legitimate economy strengthens it.

Our submission speaks directly to the Roundtable’s goal of creating a more dynamic and resilient economy. We advocate that:

• Addressing scams is a prerequisite for sustainable economic growth.

• Plugging the holes that allow financial crime to thrive will preserve capital, restore confidence in institutions, and support households and businesses in a rapidly digitising economy.

• Strengthening identity systems, harmonising regulation, and enforcing accountability will make Australia safer for innovation, accelerate the adoption of trusted digital tools, and free up resources that can be invested in the net zero transformation, skills development, and more efficient service delivery.

For every dollar we protect from fraud, we gain productivity, trust, and the opportunity to invest in a stronger future. We are eager to engage further and share survivor-led insights that can shape a safer and more trustworthy financial system.

Thank you for considering our submission.

Sincerely,

Harriet Spring

President

Scam Victim Alliance

AUSTRAC money laundering submission from SVA

SVA advocates for scam victims to be able to check that AUSTRAC has received an appropriate suspicious matter report from their financial institution if they’ve been the victim of financial crime or money laundering

Scam Victim Alliance (SVA) is a not-for-profit organisation of survivors with lived experience of scams and cyber-enabled fraud. We welcome the opportunity to provide feedback on the Second Exposure Draft of the Anti-Money Laundering and Counter-Terrorism Financing Rules 2025. The reforms proposed are a significant step forward in strengthening Australia’s AML/CTF regulatory regime.

The aim of this submission is to:

Stop scam and fraud victims bearing the financial cost of the $2+ billion lost to scams, the majority of which involve money laundering in Australia.

Increase the trust of the Australian public in the Australian financial system and AUSTRAC in particular through increased transparency.

The draft rules do not yet go far enough to address critical gaps in consumer protection, institutional accountability, and regulatory transparency. The AML/CTF framework must not only detect and deter crime, but also protect victims and hold negligent institutions accountable.

In relation to the proposed AML/CTF changes, the SVA:

Supports mandatory reimbursement of victims where financial institutions failed in their AML/CTF obligations. We recommend amending the AML/CTF Rules to require mandatory reimbursement where a financial institution’s breach of AML obligations materially enabled the commission of a financial crime;

Supports enforceable and public penalties for institutions facilitating or enabling financial crime. We recommend introducing a structured penalty regime and require AUSTRAC to publicly list all enforcement actions with plain-English summaries of the breach and penalties issued;

Supports greater transparency by AUSTRAC regarding AML/CTF breaches, investigations, and penalties. We recommend AUSTRAC being subject to legislated requirements to release annual data on suspicious reports, breaches, investigations, and penalties, including sectoral risk trends and redacted breach summaries to support public oversight;

Supports penalties for entities providing designated financial services without being registered with AUSTRAC. We recommend that the AML/CTF Rules be amended to clearly empower AUSTRAC to:

Investigate and fine entities offering designated services without registration;

Publish enforcement outcomes;

Proactively monitor for compliance breaches by non-registered operators.

Supports tightening registration standards for Remittance and Virtual Asset Service Providers. Registration alone is not enough. In fact, in some cases, registration can give false legitimacy to scam operations, especially among Remittance Service Providers (RSPs) and Virtual Asset Service Providers (VASPs).

It is important that we strengthen systemic risks and consumer safety at a structural level.

AUSTRAC’s updates in the Second Exposure Draft mark commendable progress. However, to strengthen Australia’s AML/CTF framework further, AUSTRAC must:

Enhanced Suspicious Matter Reporting (SMR) tailored to scams;

Prioritise victim protection;

Enforce accountability and transparency;

Provide public transparency of AML/CTF Enforcement and Reporting;

Actively and transparently penalise unregistered and negligent actors, including reimbursement for scam victims;

Proactively Monitor Unregistered Entities; and

Enact stronger enforcement and information sharing.

Case study: money laundering happens regularly in Australian banks

O’Brien v Supercheap Security Demonstrates the lack of protection against money laundering and financial crimes for Australians within the Australian financial system. It also shows the lack of transparency for victims of crime in regard to money laundering.

In the case of O’Brien v Supercheap Security, 13 Australian victims collectively lost $1.36 million to a fake AMP term deposit scam. The funds were transferred into a NAB mule account under the name “Supercheap Security.” Public evidence tendered to the Supreme Court of NSW and ABC-TV later revealed that this NAB business account had been compromised before any deposits were made, with login credentials sold to overseas-based scammers.

Victims believed they were transferring money into secure term deposit accounts opened in their own names. In reality, the funds were funneled into a fraudulent NAB Supercheap Security account, then rapidly moved offshore to British-controlled shell companies. While the victims secured a court judgment against the mule account holder, Hassan Mehdi, bankruptcy proceedings have made actual recovery of funds impossible.

Despite these facts, the Supercheap victims have been unable to successfully resolve complaints through AFCA because NAB - the receiving bank - has no direct relationship to the victims and therefore no obligation to disclose how and where the funds were transferred after arriving in the Supercheap Security account. NAB cited privacy and confidentiality rules, effectively shielding itself from scrutiny. The victims, lacking access to the full transaction trail, are unable to establish liability nor hold NAB accountable for its failure to detect and prevent criminal money laundering activity on its own platforms.

SVA believes AUSTRAC is integral to the public maintaining trust in the financial system

Implementing the above recommendations will align Australia’s AML system with international best practices, improve compliance, and restore public confidence in the financial system’s integrity.

SVA‘s detailed response continues over the page. We welcome the opportunity for ongoing open dialogue and look forward to constructive changes to reduce the harm Australian scam victims currently experience.

Yours faithfully,

Harriet Spring

President

Scam Victim Alliance’s detailed response to proposed AML/CTF changes

1. Reimbursement for Victims where AML/CTF Obligations were breached

Proposed Inclusion:

Introduce rules requiring that when a reporting entity breaches AML/CTF obligations and that breach contributes to customer harm from financial crime, the institution must reimburse the victim.

Justification:

Victims should not bear the cost of scams or money laundering enabled by institutional failure.

In ASIC v RI Advice Group Pty Ltd (2022), the Federal Court found that poor cyber-risk controls breached financial obligations.

The UK Contingent Reimbursement Model Code (CRM) requires reimbursement for victims of APP scams when banks fall short of expected due diligence.

The EU PSD2 and EBA Guidelines mandate redress for fraud resulting from institutional non-compliance.

Aligns with ASIC’s broader shift toward a "fairness to customer" standard under DDO and the Financial Accountability Regime.

SVA recommendation:

Amend the AML/CTF Rules to require mandatory reimbursement where a financial institution’s breach of AML obligations materially enabled the commission of a financial crime.

2. Public and Tiered Penalties for Non-Compliant Institutions

Proposed Inclusion:

Require that AML/CTF breaches result in tiered penalties based on severity, harm, and institutional size — and that these penalties are published publicly by AUSTRAC.

Justification:

Public penalties serve as a deterrent and increase trust in regulatory oversight.

AUSTRAC has previously issued large fines, including:

Westpac – $1.3 billion (2020)

CBA – $700 million (2018)

FinCEN (USA) fined Capital One $390 million for AML failings tied to a check-cashing business.

The UK FCA fined NatWest £264 million and published ongoing AML actions in a searchable registry.

SVA Recommendation:

Introduce a structured penalty regime and require AUSTRAC to publicly list all enforcement actions with plain-English summaries of the breach and penalties issued.

3. Public Transparency of AML/CTF Enforcement and Reporting

Proposed Inclusion:

Require AUSTRAC to publish a Quarterly Enforcement and Intelligence Report detailing the AML/CTF enforcement landscape.

Justification:

Agencies such as FinCEN and the UK National Crime Agency publish detailed reports to inform law enforcement, regulators, and the public.

AUSTRAC currently publishes limited summary stats, but no transparent listing of SMR outcomes, breaches, or fines.

Transparency would aid industry benchmarking and support public trust in AML regulation.

SVA Recommendation:

Legislate a requirement for AUSTRAC to release quarterly data on suspicious reports, breaches, investigations, and penalties. Include sectoral risk trends and redacted breach summaries to support public oversight.

4. Enforce Penalties for Unregistered Entities Operating Financial Services

Proposed Inclusion:

AUSTRAC should be empowered and obligated to penalise unregistered financial service providers who operate in breach of the AML/CTF Act by failing to enrol or register.

Justification:

Operating without registration violates the AML/CTF Act and undermines systemic oversight.

AUSTRAC has taken some action — e.g., deregistering iSignthis Ltd — but such enforcement is infrequent and delayed.

UK FCA and US FinCEN maintain real-time public registries and penalise unregistered actors.

Lack of enforcement enables grey-market operators and risks regulatory arbitrage.

SVA Recommendation:

Amend the AML/CTF Rules to clearly empower AUSTRAC to:

Investigate and fine entities offering designated services without registration;

Publish enforcement outcomes;

Proactively monitor for compliance breaches by non-registered operators.

5. Tighten Registration Standards for Remittance and Virtual Asset Service Providers

Proposed Inclusion:

Revise AUSTRAC’s registration process to:

Require independent vetting of business models, beneficial owners, and executive history;

Mandate ongoing monitoring, not just a one-off registration;

Publish a warning list of registered RSPs/VASPs under investigation or with compliance concerns.

Justification:

Registration ≠ credibility: Scammers often use AUSTRAC registration as a badge of legitimacy to convince victims they are regulated and safe. AUSTRAC’s current checks are mostly administrative.

Examples of abuse:

In 2023, several crypto Ponzi schemes and forex trading scams operating in Australia cited their AUSTRAC registration to build trust — despite having no legitimate operations.

Shell companies are frequently used to register remittance services, with nominee directors and no genuine compliance infrastructure.

Weak vetting process: Currently, registration does not require full background checks, prior business conduct scrutiny, or robust business model review. This creates a low barrier for entry that scammers exploit.

Comparative international approaches:

The UK FCA has refused dozens of crypto-related applicants due to AML failings — and regularly publishes registrations revoked or denied.

MAS (Singapore) requires crypto businesses to pass AML audits before being licensed.

FinCEN (US) shares alerts with the public about scam-linked registrants and shell exchanges.

SVA Recommendation:

Amend the AML/CTF Rules and registration regime to:

Require a fit-and-proper test for beneficial owners, including checks against prior fraud, insolvency, or AML breaches;

Publish a compliance rating or risk flag beside RSPs/VASPs in AUSTRAC’s public registry;

Enable AUSTRAC to suspend promotion of “registered” status by an entity under investigation;

Introduce tiered scrutiny levels — e.g., stricter review for VASPs and international remitters.

AFCA rule change submission from SVA

The Australian Financial Complaints Authority will be able to hear complaints against receiving banks from March 2026. This is what Scam Victim Alliance would like AFCA to consider.

Scam Victim Alliance (SVA) is a not-for-profit organisation of survivors with lived experience of scams and cyber-enabled fraud. We welcome the opportunity to provide this submission to the Australian Financial Complaints Authority’s (AFCA’s) call for submissions to expand AFCA’s jurisdiction over receiving banks in scams.

In relation to the proposed AFCA changes the SVA:

Supports AFCA’s proposed 2025 rule changes, particularly to help scam complaints where names and account numbers didn’t match, and less than 10% of funds were recovered and money laundering, fraud and other crimes are alleged.

Urges AFCA to enforce its Rule A.9 to Rule A.14 by requiring member firms - and potentially non-member firms - to provide all relevant information in scam cases.

Urges Treasury and regulators to step in to address the complex liability and transparency gaps between AFCA member and non-member firms, ensuring all receiving financial institutions are held accountable for their role placing and layering scammed funds, and enabling more effective recovery of scammed funds back to sending financial institutions.

Suggests urgent government and regulatory action is needed to stamp out identity theft, account takeovers and rampant ‘renting’ mule bank accounts on Australian payment, telco and social media platforms. In addition to muling, spoofing and impersonation are other issues that fuel successful scams.

We support AFCA’s proposed rule changes, especially the overdue inclusion of complaints against receiving financial institutions. Receiving financial institutions often enable scams by hosting money mule accounts that facilitate fraud, deception, and money laundering—criminal acts that are currently overlooked in AFCA’s dispute resolution process.

New legislation updating AFCA’s authorisation and the Scam Prevention Framework are positive, but scam-related complaints usually involve criminal conduct and are not simple contractual disputes. Many scams are caused or worsened by failures at the receiving financial institution, such as not verifying account names, account takeovers, ‘renting’ of accounts, failure of KYC and facilitating further placement and layering to obscure the ability of financial institutions to recover scammed money. AFCA’s laboured, confusing and sometimes ill-considered EDR processes add to the harm scam victims experience.

To be effective in its new authorisation condition, AFCA must:

Ensure complaints against receiving financial institutions fall within the six-year window from the scam date; or the time the victim first becomes aware that the receiving financial institutions accepted their funds in connection to a scam transaction.

Recognise the overlap between criminal and civil aspects of scams and fraud, and be able to compel meaningful evidence from member firms. Ideally this can extend to non-member firms, potentially with help and collaboration from state and federal law enforcement agencies.

Include in-scope all scam complaints against receiving financial institutions and any/all subsequent transfers into other member or non-member mule accounts, particularly where serious financial institution failures or crimes have occurred.

Look at the learnings of a UK precedent from 2014, when a scam victim recovered funds after the receiving financial institutions, TSB, acted on police evidence - without any ombudsman involvement, to deliver full recovery to a scam victim. This shows the value of criminal evidence, KYC checks, and direct financial institution (FI) accountability at resolving external disputes without lengthy and complex ombudsman processes.

AFCA must not weaken existing legal protections (e.g. ASIC Act, ePayments Code, Banking Code of Practice, Banking Law, ACL) and must apply consistent standards across all financial institutions, whether they are large or small, or AFCA members or not.

Too often, scam victims are denied access to critical evidence in their dispute. AFCA must actively help complainants navigate complex scams, as required under Rule A.2.1(ii), and assist complainants in understanding how and why their scam happened.

We recommend AFCA create a dedicated scam team that collaborates with law enforcement and victims with lived experience to better track emerging scam typologies and ensure victims receive fair outcomes based on all available evidence.

SVA advocates also for additional actions as outlined in Attachment A. Our detailed response continues over the page. I welcome the opportunity for ongoing open dialogue and look forward to constructive changes to reduce the harm Australian scam victims currently experience.

Yours faithfully,

Harriet Spring

Scam Victim Alliance President

Scam Victim Alliance’s detailed response to proposed AFCA changes

In relation to the proposed AFCA changes, the SVA’s submission is as follows:

CONSULTATION POINT 1: Provide AFCA with jurisdiction to deal with complaints involving a receiving bank and/or mule account

We welcome AFCA’s proposed rule changes, particularly the move to allow complaints against receiving financial institutions - a long-overdue step toward accountability.

The receiving financial institution’s money mule accounts usually facilitate impersonation, deception, fraud and money laundering - and are crimes under most state (and some Commonwealth) laws across Australia. These criminal violations are currently ignored in AFCA’s dispute resolution process. We believe the new legislation changing AFCA’s authorisation condition is a good first step to start addressing the ‘criminal’ problems with scams that currently are being ‘heard’ by an ombudsman and external dispute resolution service instead of in a court of law. Many scams are enabled by failures at the receiving financial institutions - such as not verifying account names, ignoring red flags or failing to detect account takeovers or other money mule activity. AFCA must ensure that complaints against receiving financial institutions can be raised within the six-year window from the date of the scam and/or the date the complainant first became aware of the receiving financial institutions that accepted their funds connected to a scam transaction. This often involves an extensive number of financial institutions - not only banks, but new payment platforms like Manoova or Cuscal or crypto or digital foreign currency platforms, too.

Case study: UK precedent demonstrates importance of criminal evidence and the role of the receiving bank in scam cases

A UK scam victim was defrauded £3,400 in 2014. The money was paid into a TSB receiving bank account and a police report validated this. The police report was then supplied directly to TSB, who successfully resolved the case with no need for Ombudsman resources. This important case shows:

The power of evidence in quickly resolving complex scam cases before EDR.

The importance of KYC documentation from receiving banks.

The overlap between criminal and civil evidence and justice processes required in scam cases.

For the oversight of receiving banks to be meaningful, AFCA should be able to meaningfully examine a variety of evidence, as well as compel member firms to supply it. TSB subsequently became the first UK bank to voluntarily refund scam victims.

Scam complaints that relate to mule accounts must be within AFCA’s EDR scope across all financial institutions, not only member firms. For scam complaints to be effectively resolved through AFCA’s EDR processes, they must examine all subsequent ‘hops’ or transfers into subsequent Australian financial institution accounts (and even non-member firm accounts) - specifically when:

The sending bank failed to match account names and numbers.

Less than 10% of funds were recovered, indicating systemic financial institution failures.

A crime occurred on a member firm's platform, such as fraud, receiving the proceeds of crime or money laundering.

Too often, AFCA complainants in scam cases are denied access to the evidence needed to successfully recover any funds or resolve a dispute. AFCA rule changes must preserve existing rights under the ASIC Act, Banking Code, Corporations Act, Australian Consumer Law, ePayments Code, and common law. The SPF Bill and any new codes must also not override or lower these protections, such as the proposal that smaller financial institutions (or non-member financial institutions) be held to a lower standard.

SVA knows that scam victims regularly face AFCA’s EDR processes without AFCA staff fully embracing rule A.2.1(ii) “AFCA has a duty to ‘help complainants submit a complaint’”. We contend that AFCA staff must work harder with scam victims to help complainants untangle the complex and varied factors that resulted in their financial loss. Many scam victims do not ever find out how or why they were targeted for their scammed loss and this significantly adds to the emotional and financial harm AFCA’s EDR processes force scam victims to endure. We recommend AFCA dispute resolution teams should embrace their duties under rule A.2 to help complainants untangle their scam complaint, and call for evidence from member and non-member firms that can relate to a complex interplay of information and impersonation of trusted organisations like the Australian Tax Office, Australia Post, PEXA, ASIC, Australian Stock Exchange and more.

SVA contends that AFCA has a significant role to play in helping complainants fully understand the factors at play in their scam complaint. We also recommend AFCA scam specialist teams work with law enforcement to help enable a co-operative and collaborative justice approach (just as AFCA member firms do with the Australian Financial Crimes Exchange). By helping scam victims understand how their scam occurred, AFCA and victims can hold the right corporations and regulators to account for the fast-changing scam typologies that will continue to trick people into socially engineered financial losses.

CONSULTATION POINT 2: Introduce the ability for AFCA to name financial firms who do not comply with Determinations.

Financial crime victims in Australia have disproportionately borne financial and legal liability for increasingly sophisticated scams. We recommend AFCA ensure that it enforces its own A.14 Rule and its Operational Guidelines, and use its power to require financial firms to provide all documents, information, and responses relevant to a complaint. SVA further recommends a fully transparent information-sharing process akin to the ‘discovery’ process that happens in civil court cases to compel evidence and document-sharing across the Australian payments system. We also recommend KYC documentation, AUSTRAC reports and other AML and CTF obligations be owed to the customer, as well as the government, and be supplied as part of the external dispute resolution process. AFCA is reminded such requests are already supposed to be mandatorily complied with under Rule A.9, but in practice often are not. Relevant information documentation is vital for a fair EDR process but member firms often invoke Rule A.9.1. - the need for ‘confidentiality’ - to prevent this. We recommend AFCA play a critical role to obtain vital information and anonymise it for confidentiality, whilst enabling it to form vital evidence in deciding how to resolve a dispute.

Given AFCA now proposes to have the ability to name financial firms who don’t comply with AFCA’s requests and rulings, the SVA recommends this includes publicly naming those member firms who refuse to provide information (and explain when they use Rule A.9.1 to refuse) when requested for scam cases. We further recommend that if banks and FIs want to publish the dollar amounts of “scam transactions they prevent” to market their fraud prevention, FIs should also publish numbers that explain:

How many mule accounts they reported to law enforcement (not just the Australian Financial Crimes Exchange).

What % of scam funds they recovered for their own customers.

What new real-time technologies and investments FIs make to tackle fast-changing scam typologies.