Scam Victim Alliance

join people with lived experience surviving fraud, scams & deception

About THE SVA

We are a fellowship of scam, fraud and cyber-enabled crime survivors who share experiences and work towards:

trauma-informed support and harm reduction for all scam victims

better emotional and financial recovery processes

justice to prevent deception, impersonation and fraud

We believe the globalised scamming industry is a scourge that must be stopped to protect national prosperity and security.

ABOUT SCAM VICTIM ALLIANCE

Harriet Spring campaigns for better banking, recovery and support for all Australian scam victims

thieves pretending to be A BANK stole $1.6 million from PRESIDENT harriet SPRING

Offenders impersonating ING stole $1.6m in a single transfer from the sale of Harriet’s elderly mother’s home Teachers Mutual Bank in 2024. She believes she was targeted after her mother’s house was sold.

TRIGGER WARNING: talk of suicide.

Sylvia Chou is a registered tax agent and CPA who was accused by her banks of being a scammer while trying to uncover how she’d been deceived by a sophisticated investment scam.

investment fraudsters stole more than $2.6 million from TREASURER sylvia CHOU

It began with a Facebook ad and descended into a complex fraud that two Australian banks are still pursuing Sylvia in court over. ASIC banned the investment company from operating in Australia six months after Sylvia’s first transfer - but it was too late to protect her. The Australian company who took her payments has shut down and re-opened a new entity that is currently registered with AUSTRAC and has payment apps.

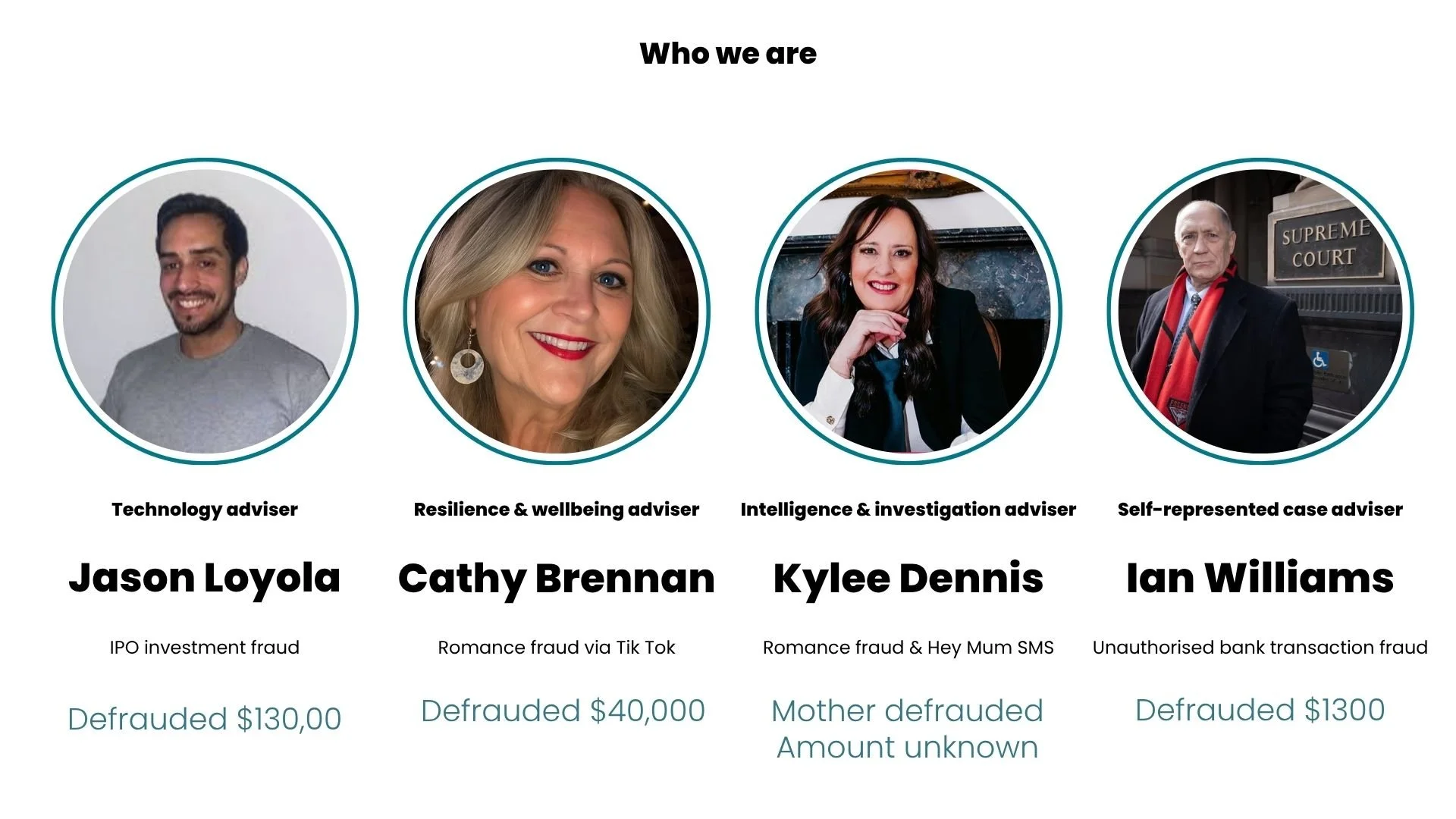

Cathy Brennan works every day talking to romance scam survivors to support them to heal and understand the scale of the global crime devastating thousands around the world.

military romance fraudsters targeted RESILIENCE ADVISOR cathY BRENNAN-COFFEY ON TIK TOK

Cathy recovered all her money after her local politician and bank rallied to help her. She now supports romance fraud victims all over the southern hemisphere through her work running Scam Haters United AUS/NZ.

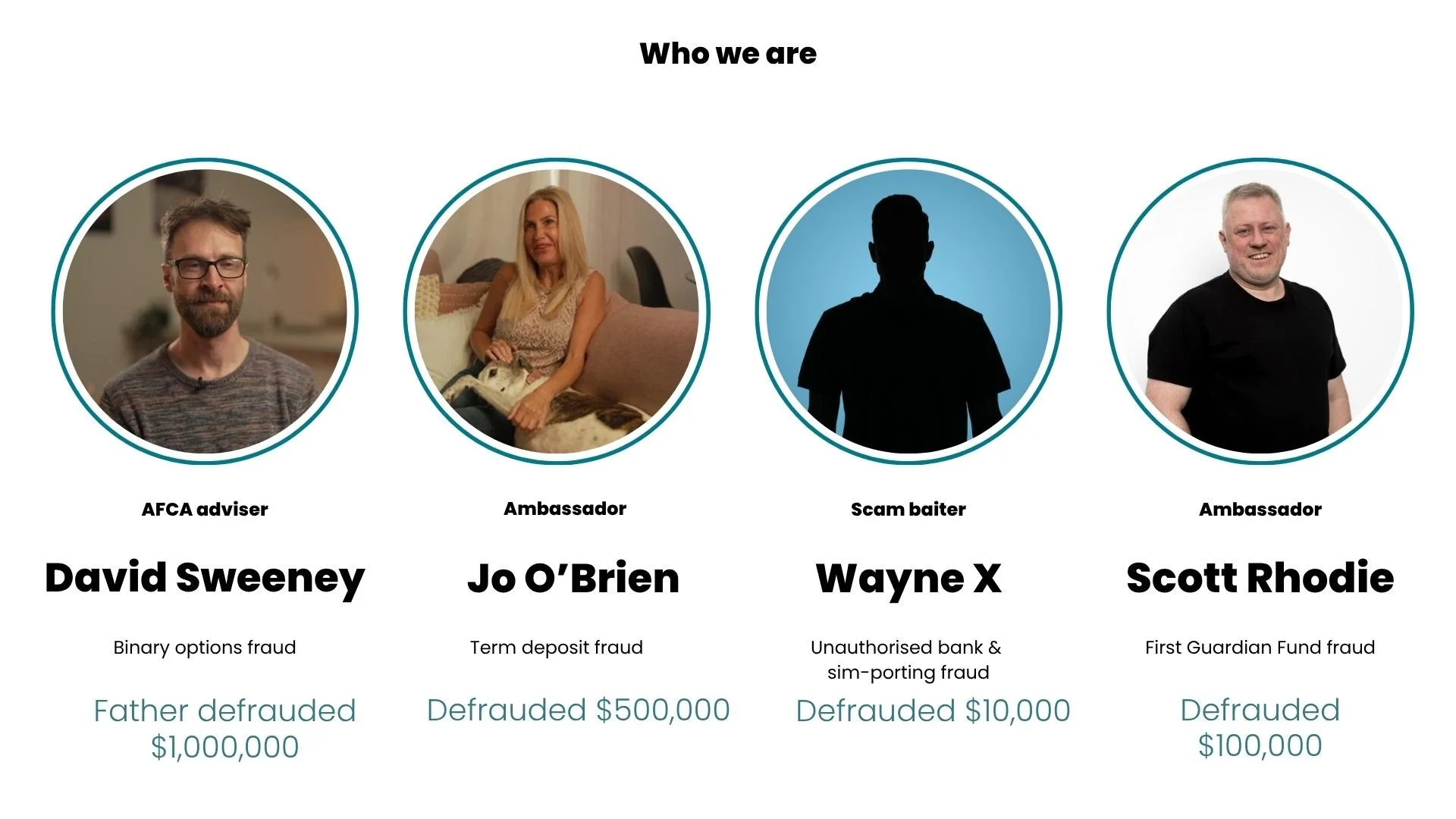

SECRETARY David spent 5 years investigating his father’s $1 million fraud - and got money back

David Sweeney’s father lost money to a binary options investment fraud - with David’s dogged research and determination, he found ASIC had told the banks not to pay money to the binary options company. He then recovered money for his father.

David Sweeney is working on new digital resources to help scam victims and other people affected by binary options fraud.

Meet barrister & solicitor David Niven ll.b.

David has been representing consumers and their interests for over 40 years. Early in his career, David held senior legal positions with the Victorian Ministry of Consumer Affairs where he was involved in legislative reform, including development and implementation of the Credit Act 1984, Chattel Securities Act 1997, Motor Car Traders Act 1986 and EFT Code of Conduct.

He also ran multi-million dollar civil penalty cases against major banks and financiers.

He then took up the position of Director of Consumer Credit Legal Service (Victoria) where he ran test case litigation and established Credit Helpline.

As Senior Consultant at Maurice Blackburn Cashman he successfully ran a series of consumer and shareholder class actions including the Aristocrat and Multiplex class actions – at the time the two largest damages awards in class actions in Australia.

This was followed by his appointment as Legal counsel at the Financial Ombudsman Service (now AFCA) and as senior solicitor at Consumer Action Law Centre.

He is now semi-retired and operates a small consumer focused law practice where he recently successfully acted for HSBC scam victims

David has also held a variety of appointments on Boards and Committees including Chair of the AFCRAA, the financial counselling peak organisation, and Chair of the National Investment Centre for Retirement Investments.

He is also the author of various publications including the Credit Handbook.