SHATTERED BUT STILL STANDING AFTER A $2.6M FRAUD

CONTENT WARNING: This post talks about self-harm. Call Lifeline on 13 11 44 if this is upsetting. SVA will be building out more support services and content as our volunteer organisation grows.

Play this 30-second video to hear Sylvia describe the impact of financial crime on her life.

In 2019, Sylvia Chou — a qualified accountant and registered tax agent— fell victim to an elaborate investment scam that would devastate her finances, her reputation, and her family.

What began as a seemingly legitimate opportunity, discovered through a Facebook ad for a new business endorsed by TV show Shark Tank, quickly spiralled into a financial nightmare.

After investing an initial $250 to set up a trading account, Sylvia underwent identity verification checks and was soon inundated by calls from a friendly account manager helping her open an online trading account in a commonly used trading platform called MT5.

From Shark Tank to how to pay billing company sharks

Confident in her previously profitable currency exchange trading experience - and background in finance - Sylvia didn’t realise she was the victim of a sophisticated social engineering scam that tricked her into making hundreds of BPAY transactions through Commonwealth Bank’s BPay master biller How To Pay Billing.

Sylvia would log into her MT5 online trading account with coaching from her account manager, who said he worked for Blue Lexus, who would send her gifts in the post congratulating her on her trading knowledge and results.

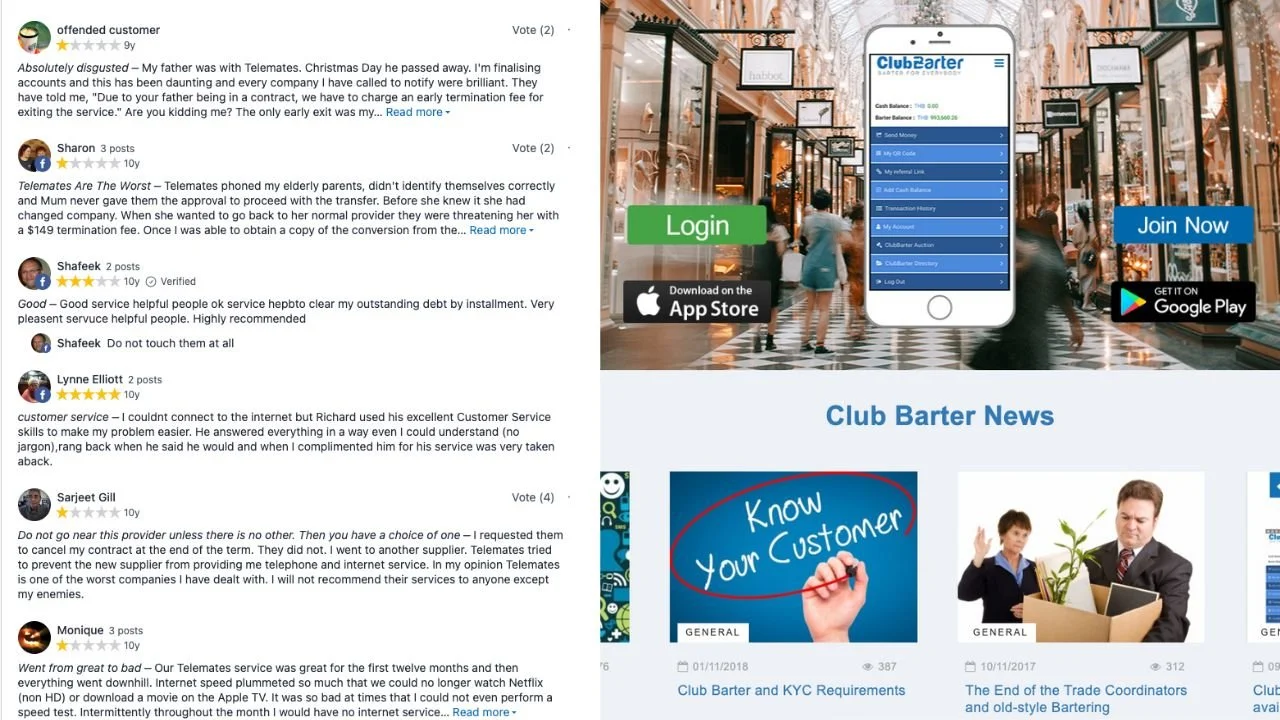

How to Pay Billing was a company owned by Telemates - which received a raft of terrible product reviews when it operated in Australia (pictured left) - and Club Barter (pictured right), which operated a similar app-based payments scheme to the new company its directors formed called Confidia. Confidia today offers a range of payment apps in the App Store and on Google Play.

Sylvia’s Blue Lexus account manager would use Teamviewer or Skype to coach her, claiming it was “one-on-one training” to help Sylvia learn trading tips and secrets.

Inside her MT5 account, Sylvia’s trading balances showed she was making thousands in profit. When she tried to withdraw her funds, Blue Lexus claimed she first had to repay the "credit" that her account manager applied to her account.

Blue Lexus said this was a company policy, so Sylvia borrowed money from family and friends to repay the credit in the hope of accessing her profitable trading account.

Just as she thought the credit was nearly paid off, the trades would suddenly incur more losses, requiring even more money.

This raised Sylvia’s suspicions. It wasn’t until a conversation with ASIC three months after her trading began that her worst fears were confirmed: she had been scammed.

The profits she could see in MT5 were all fake.

“Once they have you on the hook, it’s impossible to escape,” she says. “NAB laughed at me when I asked to increase my mortgage to get my trading profits released. They didn’t care or warn that I was likely the victim of a scam at all.”

the web of companies connected to sylvia’s fraud

How To Pay Billing is a company owned by Club Barter Australia and associated with Telemates, which had Paul Anthony Knight as a director. This company has now been voluntarily liquidated and engaged a restricted liquidator by ASIC. It’s now what is called a phoenix company, and operates How to Pay POS, a Thai-based subsidiary of Australian company Confidia.

This article explains some of the fraudulent methods and complex company structures investment entrepreneurs use to create deceptive investment schemes. Cybercriminal.com wrote this about How To Pay.

ASIC, the Australian companies regulator, issued an investor alert against GG Capital trading as Blue Lexus, but nothing against Confidia, How to Pay, Club Barter or Telemates, who played a significant role in the scam and has Australian company directors.

Sylvia’s losses kept mounting

Sylvia’s financial losses were staggering, and led to her refinancing $1.5 million in mortgages and borrowing more than $1 million from family and friends.

Perhaps more devastating was the emotional fallout. Sylvia faced skepticism and ridicule from her bank, was dismissed during the Australian Financial Complaints Authority dispute resolution process, and found herself battling despair and suicidal thoughts.

“I lost 5 kg in two weeks and was crying all the time,” she recalls. “No business, family breakdown, plus huge debt. I don’t know what else is left. I can’t see the future.”

Sylvia's story is also told in this video

Sylvia’s story reflects not just the cunning of modern ‘investment entrepreneurs’, but systemic failures - regulators that ignore phoenix companies, banks that ignore red flags, a dispute resolution system that compounded the harm, and a glaring lack of trauma-informed support for victims.

The ripple effects have been profound: banks are still pursuing Sylvia for her losses through the courts. If Westpac and NAB succeed in making Sylvia bankrupt, she won’t be able to practice as an accountant or tax agent. She is still fighting today after 6 years and has incurred thousands of dollars in legal costs.

Sylvia continues to speak up for accountability and reform. Her courage is a powerful reminder that scam victims can become survivors who deserve to be heard, believed, and supported.

Sylvia continues to help people understand the complex forces at play in investment scams and encourages other victims to understand they need support and justice, not blame.