SVA Calls for a Mandated Right to Pay in Cash to stay safe in the digital economy

Scam Victim Alliance urges Treasury to maintain cash as a protected pathway for consumers to transact safely.

With Australians losing more per person to scams than the US or UK, Scam Victim Alliance is urging the government to preserve cash access as a basic consumer protection in a broken digital economy.

We urge Treasury to view mandated cash acceptance as a critical measure to preserve consumer rights, limit harm from financial crime and uphold economic fairness

As a national network of scam victims and harm reduction advocates, we are acutely aware of the risks of our digital economy, which continues to fail Australian consumers and expose them to financial crime.

Many of our victims were trying to open a term deposit, buy a home or move or transfer their superannuation savings when they were targeted by criminals operating with impunity across Australia’s banks, digital platforms and telcos.

We urge Treasury to view mandated cash acceptance as a critical measure to preserve consumer rights, limit harm from financial crime and uphold economic fairness.

Australia needs a resilient and inclusive economy that allows cash to be accepted for essential goods and services

Digital fraud risks must be acknowledged as a driver of financial harm, with cash and cheques the only alternative for vulnerable consumers to transact safely Australians are being actively victimised by the lack of consumer protection in the digital economy, suffering higher per capita scam losses compared to the US and UK in 2023 and in 2024.

Banks and digital platforms have shifted accountability for modern fraud on to customers, rewriting their account terms and conditions to push scam liability onto customers.

Given that most of Australia’s fraud protections existed in the Cheques Act – and that cheques are being sunsetted – the right to use cash remains vital for protection from financial harm caused by lax digital and banking controls that have seen cyber-enabled crime flourish.

Many of our community members are so traumatised by their extreme financial losses that they wish to never use digital apps or online banking again.

The ePayments Code further harms consumers by actively blaming them for falling victim to a financial crime and ‘authorising’ their own loss.

Australia’s Banking Code offers more protection for consumers transacting face to face in a bank branch rather than online, which again underlines the need for broad access to cash and cheques.

• Payment misdirection fraud is the fastest growing scam type, according to the ACCC, so access to cash is a vital consumer protection.

Telcos, banks and digital platforms allow impersonation and deception with little consequence – the Scam Prevention Framework still has no codes or rules to hold corporations to account.

Banks charge interest on financial crime losses and the Australian Financial Complaints Authority endorses this . Consumers urgently need government to step up and hold a Royal Commission into the state of financial crime and money laundering across Australia’s digital economy.

Scam Victim Alliance believes the scourge of financial crime can only be addressed when the government realises the true extent of how corrupted Australia's payments system has become.

There are regulatory loopholes, rampant money laundering and profit-seeking from legitimate and illegitimate stakeholders that effectively make authorised push payment frauds legal and highly successful.

MONEY LAUNDERING ON THE STREETS OF MELBOURNE

Hope & Tom Clifford had their $250,715 property settlement money stolen in a sophisticated fraud that was set up on Snapchat with a $5000 offer to a money mule. The mule then drove around the streets of Melbourne, laundering the $250,715 by buying a gold bar, changing it into foreign currency and withdrawing cash.

Dubbo couple Hope and Tom Clifford had their $250,715 property settlement stolen by a mule with a Commonwealth Bank Account. Court documents revealed the mule was paid $5000 by malicious actors to receive the Clifford’s misdirected funds into his personal bank account, which is still operated by the mule today.

The crime gang network had also breached the Clifford’s solicitor’s email to send a forged and misdirected Commbank payment instruction to the Cliffords.

The Cliffords then went into their local NAB branch to do the payment in person. Court documents reveal the money mule was driven around Melbourne withdrawing cash from ATMs, buying foreign currency and a $94,000 gold bar with the $250,715 proceeds, which meant no money was recoverable to the Cliffords or their bank.

The mule received just 150 hours community service, with no conviction recorded. The justice system did not force a recovery or compensation order on to the mule.

No other people were arrested. This level of on-shore money laundering reveals the need for a whole-of-society approach to fighting financial crime.

The initial misdirected payment happened inside a NAB bank branch, while NAB was engaged in an enforceable undertaking with AUSTRAC to prevent money laundering.

• Digital fraud is a daily threat, not a fringe issue In this context, cash is not just a payment method—it's a tool of financial autonomy.

It is the only payment form that cannot be hacked, reversed, profiled, or denied by an algorithm. Mandated cash acceptance is one way for consumers to avoid the cybersecurity risks of online transactions.

APRA’s stakeholder survey reveals 91 per cent of banks, insurers and super funds describe cyber risks as critical or high risk, yet consumers often have no choice but to use it.

The government's own data confirms that scam losses are rising, and digital systems are failing to prevent it.

Maintaining cash access is a practical safeguard for individuals who have been, or may become, financial crime victims.

People victimised by romance and investment fraud often have their digital financial identity compromised and become unwitting money mules — including hacked bank accounts, drained savings, and flagged bank transactions.

In the aftermath of their fraud, their online banking can be locked or put under investigation. Some of these people are also ‘debanked’ and not allowed to operate accounts again. Many are too traumatised to trust digital payment systems again.

Cash becomes romance and investment fraud victims' only safe and immediate way to:

• Regain financial control without relying on compromised accounts

• Pay for essentials like food, transport, and accommodation during recovery

• Avoid re-traumatisation from using the same digital channels where the abuse occurred

• Protect privacy and limit further surveillance or manipulation from perpetrators, especially in cases involving coercive control.

2. The cash mandate must apply to all essential goods and services

Limiting cash acceptance to fuel and groceries will exclude key essentials that people rely on to live, including:

• Medicines and pharmacy items

• Rent and housing costs

• Utilities (electricity, gas, water)

• Public transport and essential travel

• Telecommunications (phones and internet)

This is not a theoretical issue. Many Australians - especially older people, regional residents, people with disabilities, and financially excluded groups - are being left behind in the digital economy.

A narrow cash mandate creates loopholes that accelerate digital coercion and economic control by institutions, who continue to profit by turning a blind eye to financial crime on their platforms.

We urge Treasury to require cash acceptance for all essential transactions to ensure consumer protections.

IAN WILLIAMS: A CASE STUDY AS TO WHY CASH IS VITAL FOR VULNERABLE AUSTRALIANS

Pensioner Ian Williams was scammed $1300 from his Google Pay Ubank account, operated by NAB.

His bank – and the Australian Financial Complaints Authority - blamed him for the fraud, even though he had CCTV footage showing criminals buying gift cards with his card, more than 100km from where he was located at the time of the payment.

Ian has been in a two-year+ fight self-representing himself at court to seek justice. His health has suffered.

As a consequence of the trauma and financial cost, he now refuses to transact digitally. He relies on cash to participate in the economy.

“My money is not safe in the bank, and if there is an issue, I will be blamed. If I have cash on me, I have control of it," he says.

“In the bank I have no control over my transactions, no security, no support.”

Ian contends the bank has still not given an adequate reason as to how his $1300 was taken from his account, only accusing him of being responsible for it.

3. The $500 cash limit is unreasonably low if we want to be prepared for natural disasters or cyber outages

Many essential costs exceed $500, including:

• Rental bond payments

• Quarterly utility bills

• Essential car repairs

• Bulk groceries or fuel purchases for remote travel

A $500 ceiling effectively blocks consumers from using cash in situations where it matters most.

If there is concern about abuse (e.g. large-scale money laundering), exceptions can be carved out — but the default must support high-value essential cash payments, with monitoring.

This is the approach Minister Tony Burke has outlined for monitoring crypto ATMs .

Reserve Bank Governor Michelle Bullock has acknowledged how essential cash is – even though just 10 per cent of economic transactions are done with it – and confirms that it must be available as a back up when digital systems are unavailable (such as in a natural disaster, digital outages or a cyber attack on vital infrastructure).

4. Retailer cash exemption pathways are too wide

The current proposal seems to allow the ACCC to exempt entire retail chains or site classes from holding cash.

It also exempts all businesses under $10 million turnover, including many mid-sized regional retailers. In practice, this means a regional town may have zero cash acceptance points for essentials, even where local demand is strong.

The proposed regulatory design prioritises operational comfort for retailers over the public interest.

We recommend:

• Narrowing the small business exemption to <$1 million turnover

• Requiring transparent public reporting of all exemptions granted by the ACCC.

Cash acceptance cannot become optional based on the subjective operational preferences of corporations.

5. Supermarkets and large chains must maintain meaningful cash capacity

While we welcome the "reasonable opportunity" language in the draft, it is vague and easily undermined in practice.

We already hear from victims who face:

• Long queues at the only staffed register

• "Card-only" signage at self-checkouts

• Staff discouraging cash through misinformation or passive barriers

To avoid these abuses, we recommend:

• Requiring at least 50% of payment terminals at large retailers to accept cash

• Prohibiting signage that discourages or misrepresents cash acceptance

• Mandating staff training to support compliance with money laundering laws

Cash acceptance must be functional and practical, not just technically present.

6. The cash mandate must be monitored and enforced

Regulation without enforcement invites exploitation.

Treasury must ensure:

• Clear reporting obligations for retailers

• A consumer complaint mechanism for breaches

• Published penalties and compliance data to build trust

The proposed 6-month grace period should be shortened or phased with public progress reporting to ensure momentum is not lost.

The right to use cash must not be quietly eroded through neglect, loopholes, or economic exclusion.

If Australians cannot rely on digital systems to protect them — and current scam statistics show they cannot — then the government must protect the option to pay safely with cash.

We urge Treasury to strengthen the draft regulations by:

• Expanding the mandate to all essentials

• Lifting the cash transaction ceiling

• Tightening exemptions

• Enforcing real-world compliance

• Releasing the codes and rules that support the Scam Prevention Framework

We urge the federal government and its regulated agencies to work harder with financial institutions and groups such as ours to stamp out blatant money laundering and financial crime across the Australian system.

Digital dependence does not deliver economic resilience or justice.

Cash is one pathway for consumers to remain protected while transacting in the economy given the appalling lack of consumer protections for people being robbed through their bank accounts in Australia.

The Scam Victim Alliance stands ready to work with government to protect the economic dignity and security of all Australians.

Scam Survivors Urge Lawmakers to Close Loopholes in Australia’s Crypto Bill

Scam Victim Alliance urges Treasury to mandate reimbursement, fund asset recovery, and expand crypto regulation, warning that reform without restitution fails victims and emboldens financial criminals.

Scam Victim Alliance urges Treasury to mandate reimbursement, fund asset recovery, and expand crypto regulation, warning that reform without restitution fails victims and emboldens financial criminals.

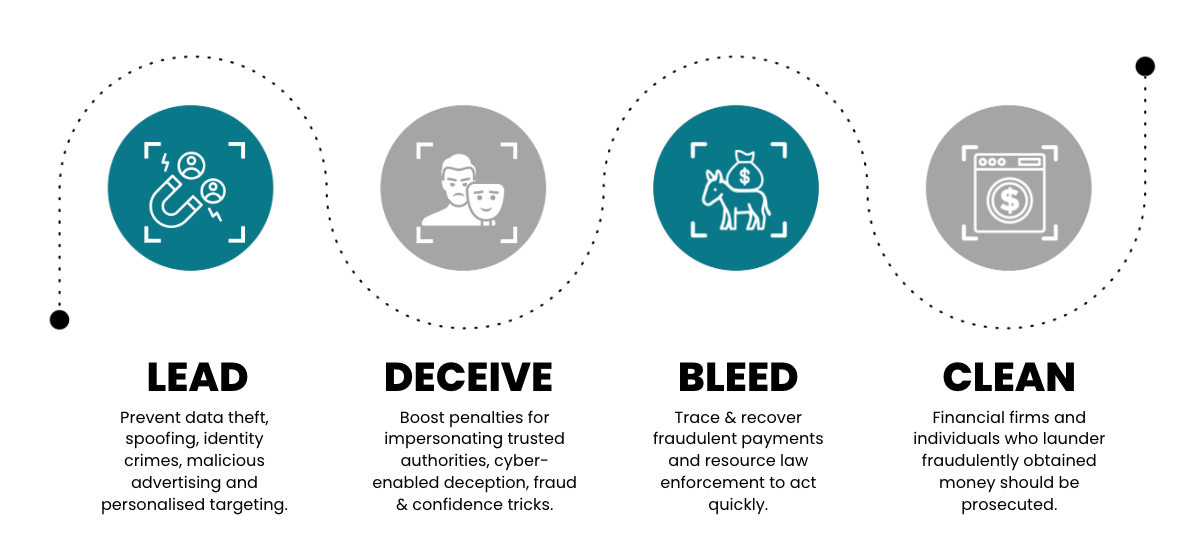

All scams - whether they relate to crypto or not - follow these four patterns.

Submission: Feedback on the Treasury Laws Amendment (Regulating Digital Asset, and Tokenised Custody, Platforms) Bill 2025

Scam Victim Alliance a group of cyber-enabled fraud and money laundering victims with lived experience of the harm that Australia’s financial system unwittingly inflicts on everyday Australians trying to pay, transact or invest in assets to secure their future.

We welcome the Australian Government’s initiative to modernise the regulatory framework for digital asset platforms and tokenised custody platforms, as set out in the Exposure Draft Bill, Explanatory Memorandum, Fact Sheet, and Consultation Questions.

The policy intent - to enhance consumer protection, close regulatory gaps, and align with international “same activity, same risk, same regulation” principles - is sound. However, we draw attention to glaring omissions in consumer restitution and recovery of lost or stolen digital assets.

1. Regulation Must Include Protection and Reimbursement

If the government wants to regulate digital assets as financial products, it must also ensure these assets have the same regulatory protection as money and securities in the traditional financial system.

While the Bill applies general obligations to licensees (such as acting efficiently, honestly, and fairly, and maintaining adequate compensation arrangements), this does not go far enough.

A reimbursement and recovery mechanism must be explicitly included in the law, especially for retail consumers who suffer loss due to:

• cyber-enabled deception that deceives retail end users;

• platform insolvency,

• fraud and theft,

• operational failure or hacking, or

• negligence, theft or fraud by licensed intermediaries.

Regulation without restitution will leave consumers unprotected in the very situations that prompted this reform.

The history of banking regulation in Australia shows that without mandatory reimbursement (for example, when victims of authorised push payment fraud are left uncompensated), institutions will always prioritise commercial interest over consumer recovery.

The Australian Payments System Review in 2021 rightly pointed out how rife fraud, trickery and deception is amongst tokens, digital asset platforms and tokenized custody platforms and it’s our lived experience that this has escalated dramatically since 2021.

We regularly hear horrific stories of harm where people believe they are ‘investing’ or ‘trading’ only to have their life savings hijacked by financial criminals. These victims are then commonly de-banked by the traditional financial system, losing access to the vital accounts needed to rebuild and recover after such devastating experiences.

Financial crime is a complex global issue which we believe can be more effectively tackled domestically by improving law enforcement and regulatory outcomes across four main pillars.

2. The Government and Law Enforcement Must Leverage Crypto Traceability Tools and Law Enforcement Must Be Resourced to Recover Assets from Overseas

Unlike fiat or traditional money, digital assets are inherently traceable.

Modern blockchain forensics tools allow rapid identification of wallet addresses, asset movement, and ownership patterns. The government should therefore:

• establish a dedicated crypto tracing and recovery taskforce jointly operated by Treasury, ASIC, AUSTRAC, and the AFP with adequate resourcing to fund international recovery;

• empower regulated exchanges and wallet providers to comply with asset-freezing and restitution orders; and

• require reporting and cooperation frameworks between exchanges and law enforcement.

This would ensure that regulation does not merely impose compliance costs but also provides meaningful remedies for victims. Like the way Australian Financial Complaints Authority funding works, these protections could be funded by levies on larger financial firm profits rather than a direct levy on a flourishing startup industry. The funding could also be tied to the loss amounts sending financial firms lose to financial crime each year, ensuring that the firms with the most power to reduce crime invest to prevent it.

3. Protection Must Extend Beyond Centralised Exchanges

The consultation papers correctly note that major losses have occurred because custodial intermediaries hold assets without adequate segregation or protection.

However, the regulatory perimeter should also consider:

• Hot and cold wallet storage (both institutional and private),

• Tokenised asset custody outside exchange environments,

• Decentralised or hybrid custodial services, and

• Cross-border platforms that service Australian consumers but operate offshore.

Without addressing these, consumer protections will remain incomplete and inconsistent.

We also believe the issue of crypto ATM machines in publicly available areas needs to be examined, as these can become hotspots for financial crime victims being duped and deceived into becoming unwitting money mules.

We support Treasury and law enforcement actions to scrutinise the cash-to-crypto and deception-to-crime pipelines to actively prevent financial crime being committed on Australian territory. We believe financial crime can be more easily thwarted by focussing law enforcement efforts

4. A Statutory Consumer Reimbursement Scheme

A reimbursement mechanism, similar to the UK’s mandatory fraud reimbursement scheme should be established for digital asset transactions.

This scheme should:

• require regulated platforms to contribute to a consumer protection fund,

• guarantee reimbursement to small business and consumers for verified cases of loss due to platform failure or unauthorised transactions, and

• ensure rapid resolution through AFCA or a new equivalent statutory body, such as a Payment Systems Regulator.

This would close the gap between financial regulation and consumer outcomes, ensuring the regime truly delivers “same risk, same protection.”

Banks refused to help, Australian crypto platform did. Consumer-centric reform that reimburses

Australia should support a globally competitive tokenised custody and digital asset platform industry. This vision will not be realised if the sector is dominated by a handful of established financial institutions that suppress innovation to develop secure and decentralised financial services.

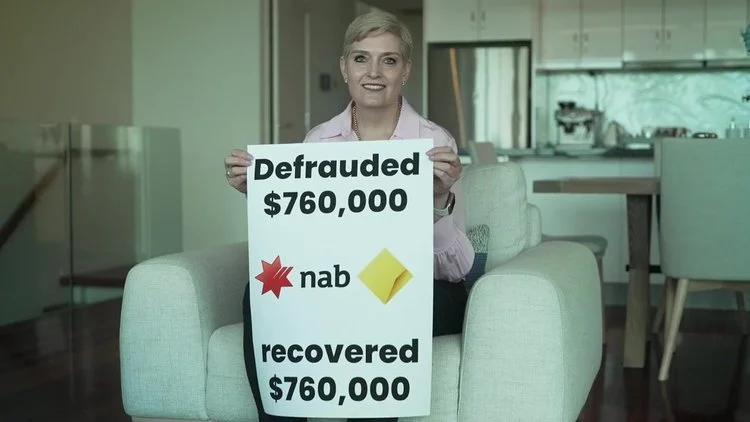

While we support major banks taking action to limit high-risk crypto transactions under the banner of consumer protection , we must also call out the double standard evident in the case of Scam Victim Alliance supporter Jacomi Du Preez , who lost $760,000 to a sophisticated bank impersonation fraud.

Jacomi had received a life insurance payout following the death of her husband and sought to place the funds in a term deposit. She approached both Commonwealth Bank and National Australia Bank, asking them to verify the legitimacy of the Macquarie Bank term deposit platform she was directed to. Both banks declined, telling her it was her own responsibility.

After realising she had been scammed, Jacomi contacted a friend in Treasury, which helped trace the funds from the banks to various recipients. She was not provided with visibility into who controlled the platforms that received her money, but she independently contacted the platforms to report the fraud.

In a remarkable act of integrity, Elbaite, an Australian digital asset platform that held a portion of the stolen funds, returned the money after Jacomi reached out. According to her, CEO Morty Tollo personally responded and refunded the full amount without delay.

As a survivor-led organisation, we commend Elbaite’s victim-first response, which stands in stark contrast to the lack of proactive support from major banks. This case illustrates that emerging digital platforms can, and do, demonstrate leadership in protecting consumers—often better than traditional financial institutions.

We urge regulators to ensure that all participants in the financial ecosystem are held to the same standards, and that the regulatory environment fosters innovation, fairness, and accountability—not protectionism.

Consumer outcomes must be the primary focus. Regulatory frameworks should not serve to entrench monopolies or prioritise the interests of powerful lobby groups at the expense of safer, more innovative solutions.

Every financial crime victim deserves to know:

• Where their money went,

• Which platforms received it, and

• For law enforcement to pursue the offenders

• For law enforcement to be incentivised to respond to these crimes by allowing them fast access to the required transaction information and strong enough laws to prosecute offenders.

We strongly support increased funding for law enforcement to trace and recover stolen funds and digital assets—no matter the platform or jurisdiction involved.

5. Alignment with the Original Intent of Digital Assets

It is important to recognise that the purpose of cryptocurrencies and digital assets was to decentralise financial control and reduce dependence on traditional banks and governments.

If the government seeks to regulate this space, it must do so without replicating the same systemic failures seen in banking—particularly the lack of accountability for consumer loss and slow response to fraud.

We believe the government has a responsibility to fund law enforcement – or law reform – to strengthen that ability to control individuals, digital asset platforms and financial firms in Australian territories who:

• Perpetrate or encourage others to perpetrate cyber-deception, impersonation, identity crimes, privacy breaches, email theft, mail theft, spoofing and other pre-transaction financial crimes

• Recruit money mules and commit identity fraud, spoofing, digital deception and other acts that lay the groundwork for modern push payment fraud

• Fail to release timely information to law enforcement when a crime has been reported.

Summary of SVA Recommendations

1. Include a statutory reimbursement and recovery framework within the Bill for losses incurred through licensed platforms.

2. Establish a national crypto asset recovery and trace unit within Treasury/ASIC/AUSTRAC which is funded to pursue active recovery of assets.

3. Mandate cooperation between regulated exchanges, custodians, and law enforcement for tracing and restitution.

4. Expand coverage to include hot/cold wallets and cross-border custody arrangements.

5. Ensure retail consumer protection parity with traditional finance.

6. Examine cheap and effective ways to bolster law enforcement’s ability to respond to financial crime.

7. Look at the issue of ‘de-banking’ crypto-related financial crime victims from traditional financial firms like banks – strengthen the chain of custody on payments to eradicate crime and identify perpetrators.

The proposed framework is a crucial step forward. However, to build public trust and deliver true consumer safety, regulation must come with protection.

Australians must not face the same gaps in accountability and restitution that currently exist in the banking system.

Thank you for considering our submission.

Sincerely,

Harriet Spring

President