Scam Survivors Urge Lawmakers to Close Loopholes in Australia’s Crypto Bill

Scam Victim Alliance urges Treasury to mandate reimbursement, fund asset recovery, and expand crypto regulation, warning that reform without restitution fails victims and emboldens financial criminals.

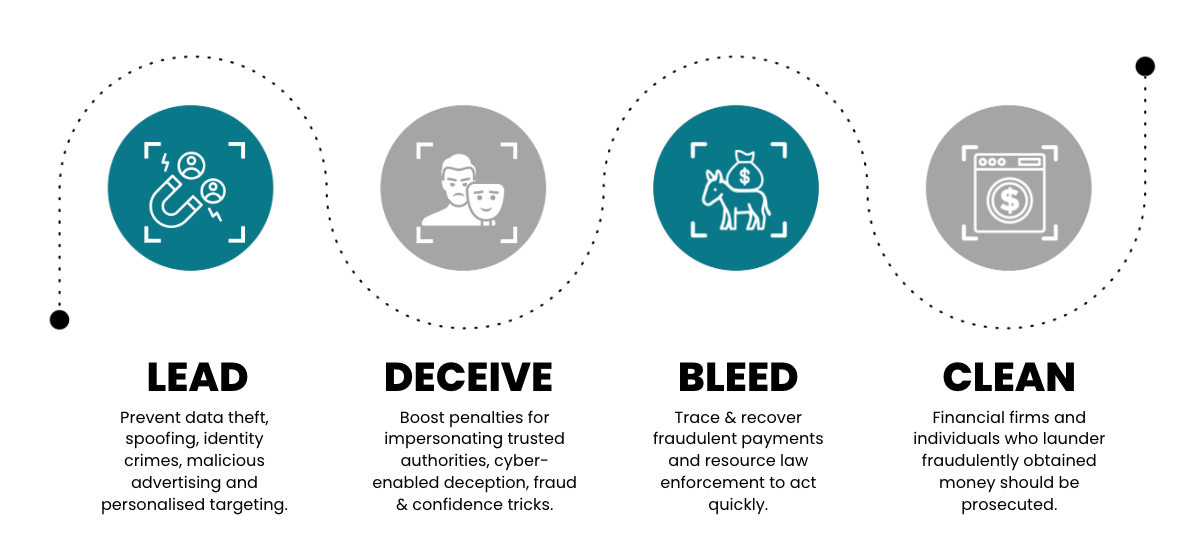

All scams - whether they relate to crypto or not - follow these four patterns.

Submission: Feedback on the Treasury Laws Amendment (Regulating Digital Asset, and Tokenised Custody, Platforms) Bill 2025

Scam Victim Alliance a group of cyber-enabled fraud and money laundering victims with lived experience of the harm that Australia’s financial system unwittingly inflicts on everyday Australians trying to pay, transact or invest in assets to secure their future.

We welcome the Australian Government’s initiative to modernise the regulatory framework for digital asset platforms and tokenised custody platforms, as set out in the Exposure Draft Bill, Explanatory Memorandum, Fact Sheet, and Consultation Questions.

The policy intent - to enhance consumer protection, close regulatory gaps, and align with international “same activity, same risk, same regulation” principles - is sound. However, we draw attention to glaring omissions in consumer restitution and recovery of lost or stolen digital assets.

1. Regulation Must Include Protection and Reimbursement

If the government wants to regulate digital assets as financial products, it must also ensure these assets have the same regulatory protection as money and securities in the traditional financial system.

While the Bill applies general obligations to licensees (such as acting efficiently, honestly, and fairly, and maintaining adequate compensation arrangements), this does not go far enough.

A reimbursement and recovery mechanism must be explicitly included in the law, especially for retail consumers who suffer loss due to:

• cyber-enabled deception that deceives retail end users;

• platform insolvency,

• fraud and theft,

• operational failure or hacking, or

• negligence, theft or fraud by licensed intermediaries.

Regulation without restitution will leave consumers unprotected in the very situations that prompted this reform.

The history of banking regulation in Australia shows that without mandatory reimbursement (for example, when victims of authorised push payment fraud are left uncompensated), institutions will always prioritise commercial interest over consumer recovery.

The Australian Payments System Review in 2021 rightly pointed out how rife fraud, trickery and deception is amongst tokens, digital asset platforms and tokenized custody platforms and it’s our lived experience that this has escalated dramatically since 2021.

We regularly hear horrific stories of harm where people believe they are ‘investing’ or ‘trading’ only to have their life savings hijacked by financial criminals. These victims are then commonly de-banked by the traditional financial system, losing access to the vital accounts needed to rebuild and recover after such devastating experiences.

Financial crime is a complex global issue which we believe can be more effectively tackled domestically by improving law enforcement and regulatory outcomes across four main pillars.

2. The Government and Law Enforcement Must Leverage Crypto Traceability Tools and Law Enforcement Must Be Resourced to Recover Assets from Overseas

Unlike fiat or traditional money, digital assets are inherently traceable.

Modern blockchain forensics tools allow rapid identification of wallet addresses, asset movement, and ownership patterns. The government should therefore:

• establish a dedicated crypto tracing and recovery taskforce jointly operated by Treasury, ASIC, AUSTRAC, and the AFP with adequate resourcing to fund international recovery;

• empower regulated exchanges and wallet providers to comply with asset-freezing and restitution orders; and

• require reporting and cooperation frameworks between exchanges and law enforcement.

This would ensure that regulation does not merely impose compliance costs but also provides meaningful remedies for victims. Like the way Australian Financial Complaints Authority funding works, these protections could be funded by levies on larger financial firm profits rather than a direct levy on a flourishing startup industry. The funding could also be tied to the loss amounts sending financial firms lose to financial crime each year, ensuring that the firms with the most power to reduce crime invest to prevent it.

3. Protection Must Extend Beyond Centralised Exchanges

The consultation papers correctly note that major losses have occurred because custodial intermediaries hold assets without adequate segregation or protection.

However, the regulatory perimeter should also consider:

• Hot and cold wallet storage (both institutional and private),

• Tokenised asset custody outside exchange environments,

• Decentralised or hybrid custodial services, and

• Cross-border platforms that service Australian consumers but operate offshore.

Without addressing these, consumer protections will remain incomplete and inconsistent.

We also believe the issue of crypto ATM machines in publicly available areas needs to be examined, as these can become hotspots for financial crime victims being duped and deceived into becoming unwitting money mules.

We support Treasury and law enforcement actions to scrutinise the cash-to-crypto and deception-to-crime pipelines to actively prevent financial crime being committed on Australian territory. We believe financial crime can be more easily thwarted by focussing law enforcement efforts

4. A Statutory Consumer Reimbursement Scheme

A reimbursement mechanism, similar to the UK’s mandatory fraud reimbursement scheme should be established for digital asset transactions.

This scheme should:

• require regulated platforms to contribute to a consumer protection fund,

• guarantee reimbursement to small business and consumers for verified cases of loss due to platform failure or unauthorised transactions, and

• ensure rapid resolution through AFCA or a new equivalent statutory body, such as a Payment Systems Regulator.

This would close the gap between financial regulation and consumer outcomes, ensuring the regime truly delivers “same risk, same protection.”

Banks refused to help, Australian crypto platform did. Consumer-centric reform that reimburses

Australia should support a globally competitive tokenised custody and digital asset platform industry. This vision will not be realised if the sector is dominated by a handful of established financial institutions that suppress innovation to develop secure and decentralised financial services.

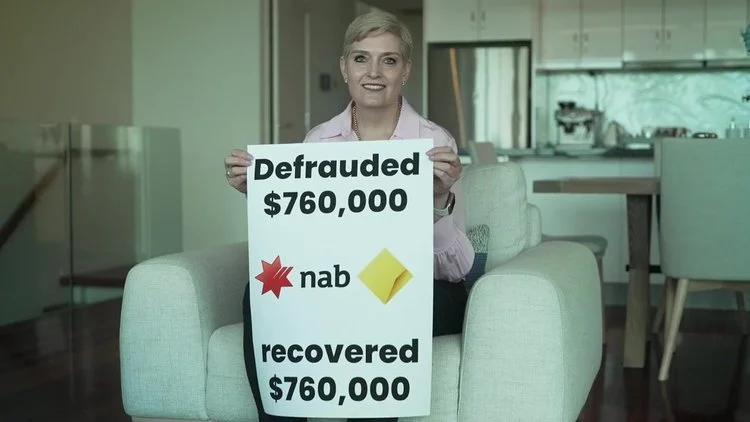

While we support major banks taking action to limit high-risk crypto transactions under the banner of consumer protection , we must also call out the double standard evident in the case of Scam Victim Alliance supporter Jacomi Du Preez , who lost $760,000 to a sophisticated bank impersonation fraud.

Jacomi had received a life insurance payout following the death of her husband and sought to place the funds in a term deposit. She approached both Commonwealth Bank and National Australia Bank, asking them to verify the legitimacy of the Macquarie Bank term deposit platform she was directed to. Both banks declined, telling her it was her own responsibility.

After realising she had been scammed, Jacomi contacted a friend in Treasury, which helped trace the funds from the banks to various recipients. She was not provided with visibility into who controlled the platforms that received her money, but she independently contacted the platforms to report the fraud.

In a remarkable act of integrity, Elbaite, an Australian digital asset platform that held a portion of the stolen funds, returned the money after Jacomi reached out. According to her, CEO Morty Tollo personally responded and refunded the full amount without delay.

As a survivor-led organisation, we commend Elbaite’s victim-first response, which stands in stark contrast to the lack of proactive support from major banks. This case illustrates that emerging digital platforms can, and do, demonstrate leadership in protecting consumers—often better than traditional financial institutions.

We urge regulators to ensure that all participants in the financial ecosystem are held to the same standards, and that the regulatory environment fosters innovation, fairness, and accountability—not protectionism.

Consumer outcomes must be the primary focus. Regulatory frameworks should not serve to entrench monopolies or prioritise the interests of powerful lobby groups at the expense of safer, more innovative solutions.

Every financial crime victim deserves to know:

• Where their money went,

• Which platforms received it, and

• For law enforcement to pursue the offenders

• For law enforcement to be incentivised to respond to these crimes by allowing them fast access to the required transaction information and strong enough laws to prosecute offenders.

We strongly support increased funding for law enforcement to trace and recover stolen funds and digital assets—no matter the platform or jurisdiction involved.

5. Alignment with the Original Intent of Digital Assets

It is important to recognise that the purpose of cryptocurrencies and digital assets was to decentralise financial control and reduce dependence on traditional banks and governments.

If the government seeks to regulate this space, it must do so without replicating the same systemic failures seen in banking—particularly the lack of accountability for consumer loss and slow response to fraud.

We believe the government has a responsibility to fund law enforcement – or law reform – to strengthen that ability to control individuals, digital asset platforms and financial firms in Australian territories who:

• Perpetrate or encourage others to perpetrate cyber-deception, impersonation, identity crimes, privacy breaches, email theft, mail theft, spoofing and other pre-transaction financial crimes

• Recruit money mules and commit identity fraud, spoofing, digital deception and other acts that lay the groundwork for modern push payment fraud

• Fail to release timely information to law enforcement when a crime has been reported.

Summary of SVA Recommendations

1. Include a statutory reimbursement and recovery framework within the Bill for losses incurred through licensed platforms.

2. Establish a national crypto asset recovery and trace unit within Treasury/ASIC/AUSTRAC which is funded to pursue active recovery of assets.

3. Mandate cooperation between regulated exchanges, custodians, and law enforcement for tracing and restitution.

4. Expand coverage to include hot/cold wallets and cross-border custody arrangements.

5. Ensure retail consumer protection parity with traditional finance.

6. Examine cheap and effective ways to bolster law enforcement’s ability to respond to financial crime.

7. Look at the issue of ‘de-banking’ crypto-related financial crime victims from traditional financial firms like banks – strengthen the chain of custody on payments to eradicate crime and identify perpetrators.

The proposed framework is a crucial step forward. However, to build public trust and deliver true consumer safety, regulation must come with protection.

Australians must not face the same gaps in accountability and restitution that currently exist in the banking system.

Thank you for considering our submission.

Sincerely,

Harriet Spring

President