5 ways to avoid switching your super to a dud fund

It’s natural that most people will want their retirement savings and superannuation to perform well.

Superannuation helps people financially secure their retirement - and the Australian government forces all employers to pay it on behalf of their employees.

Scammers, financial criminals and overly ambitious business operators have led to financial disaster for more than 12,000 Australians in 2025.

self-managed super funds are higher risk than industry or mysuper funds

Industry and MySuper superannuation funds are tightly regulated and designed to be low-cost, low-risk.

If a digital ad or a person from a call centre tells you your fund is “underperforming,” ask who they work for and why they’re saying that.

Ask what commission they are earning and ask to see their credentials - a LinkedIn profile, a valid email and ask what business they are working from.

High-pressure tactics = red flags.

Use Australian Tax Office online services to check and compare your super - and use the YourSuper comparison tool.

Other quality online tools to help you understand how your own superannuation is performing include:

2. don’t take ads or phone calls about your super at face value

Facebook, Google and LinkedIn ads that promise ‘better returns’ on your super led to the collapse of First Guardian and Shield master funds.

These ads usually require people to start a self-managed super fund - it’s important for people to understand the risk that leads to the higher returns of these types of superannuation or retirement structures.

Self-managed super funds are not regulated in the same way as APRA-regulated funds - you can check the register of regulated funds at this APRA link.

Check the ASIC registers and double-check to make sure any ads or people trying to get you to switch your super or set up a self-managed super fund are not impersonating a legitimate business.

Self-managed superannuation funds are useful for people with large superannuation balances. But they are riskier than regular industry-style MySuper funds.

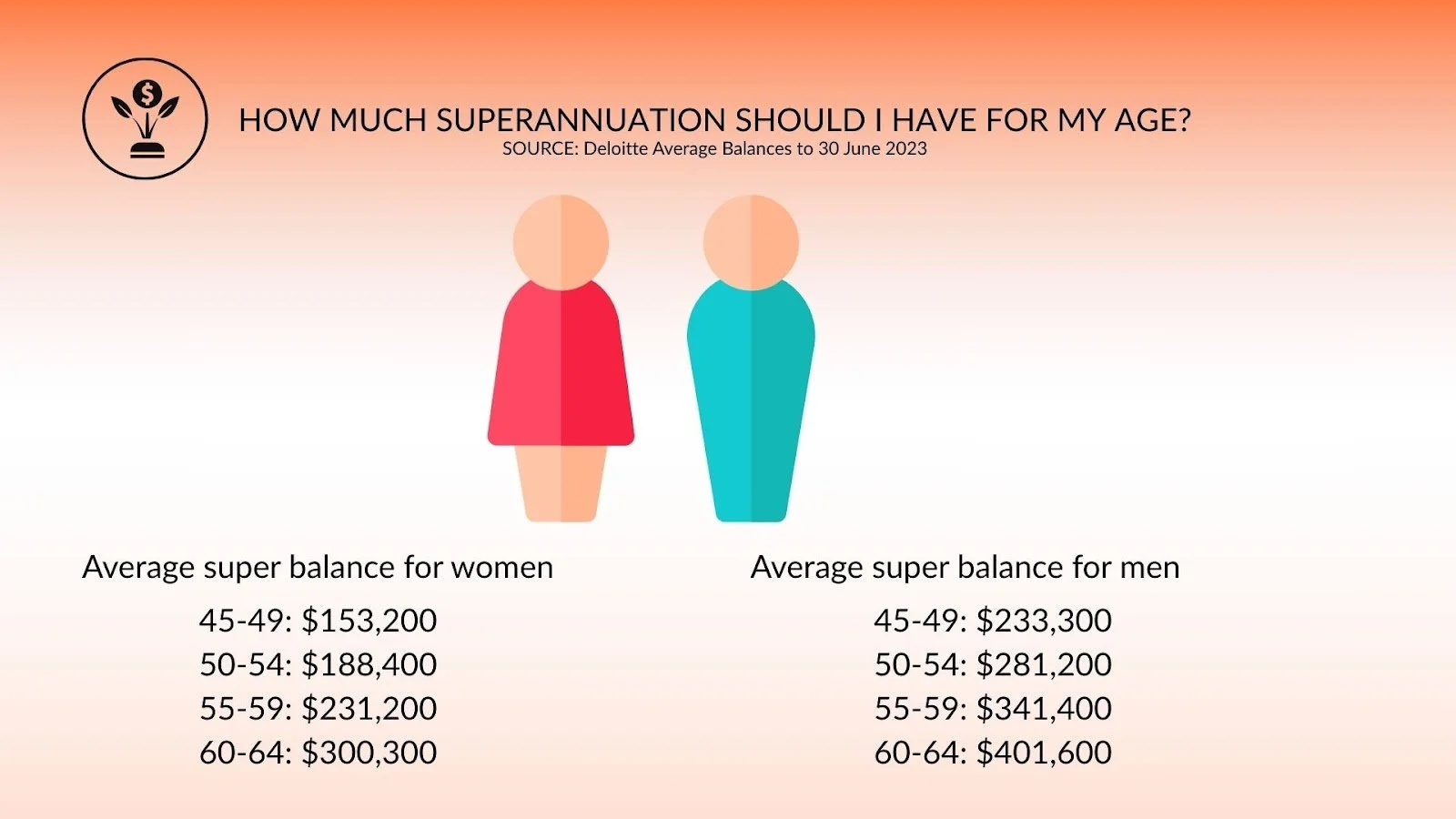

Read this article to get an idea of the ‘average superannuation balance for your age’ - don’t enter details into an online comparison tool.

3. TAKE personal financial advice ONLY from someone you can look in the eye

Only trust licensed financial advisers you can meet face-to-face.

Avoid anyone you can’t verify via ASIC’s Financial Adviser Register. Word-of-mouth recommendations are safer than random online outreach.

Read more about how to find a quality financial advisor to talk to about your super. Services Australia also offer a free Financial Information Service.

4. be wary of anyone promising you early access to your super

This is a classic scam. You can’t legally access your super early unless under strict conditions – and scammers offering loopholes are stealing your future. If in doubt, call your super fund.

Read Moneysmart’s advice about superannuation scams.

5. superannuation trustees are accountable for your super fund

A ‘trustee’ is someone who helps regulate and oversee that your superannuation is functioning as it should.

In the First Guardian and Shield collapse, ASIC is now suing large trustees for their role in the collapsed investment schemes.

Regulation is a vital way to protect people from the harm of financial crime and cyber-enabled deception.

The Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investment Commission (ASIC) are this country’s two main regulators overseeing superannuation.