5 things to know about shield & first guardian collapse

if you’re one of the 12,000 people who’ve lost their super - act now to recover your money as there are time limits in place

1. confirm if You’re Affected by shield or first guardian fund collapse

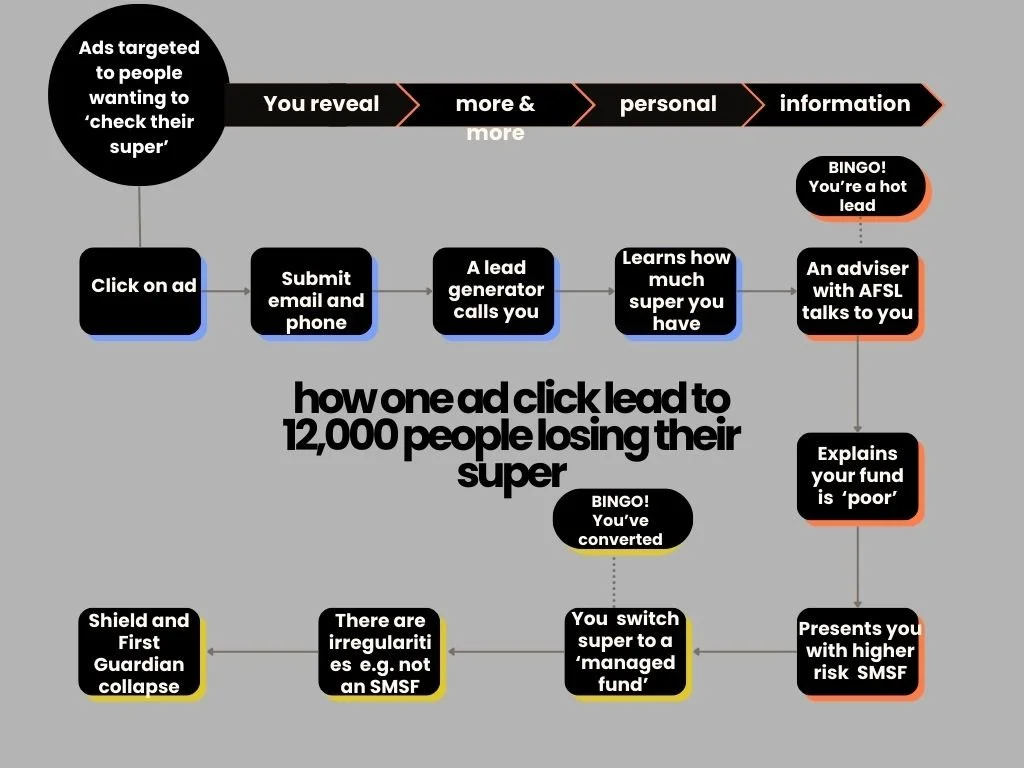

If you’ve ever received a call about your superannuation or investments after clicking on a “compare your super” website or digital ad …

Or you’ve been sent an ‘event notice’ by your super fund, then you may be affected.

The corporate cop ASIC has called this collapse “misconduct at an industrial scale” and taken court action against a range of different entities, from financial planners to superannuation trustees. It has also notified most affected people.

Some investors realised that the funds weren’t paying out in May 2024 and then some noticed their balances collapsed in July.

Others found emails in their spam folders explaining they had lost all their superannuation.

Now that the Shield and First Guardian master funds are in liquidation, it could take years for affected people to learn how much money the liquidators may return or what the Australian Financial Complaints Authority (AFCA) process can refund.

ACTION: Gather all documentation, emails and details about your superannuation, self-managed superannuation or what is really a managed investment scheme. Your Statement of Advice and other details will be important. You can also call ASIC or AFCA to find out more.

2. start action for recovery of your money

This can be a long and overwhelming process.

Note that some trustees are reimbursing victims - go through your documentation to find out if yours will, too. You can at least write a letter to them requesting they address your complaint.

register your loss with the liquidator

The liquidator’s job is to investigate what went wrong and whether there was misconduct in the fund collapse. They will identify and sell assets owned by the failed fund (property, shares, cash, etc.) and then collect money from those sales into a central pool.

Liquidators only pay creditors and investors from what’s left — usually in a set order (secured creditors like banks first, then investors).

For investors, this means:

You need to register your loss with the liquidator (usually by completing a claim form).

The liquidator will then assess all claims and, if funds are available after assets are sold, distribute payments back to registered investors.

This process can take months or even years.

Many people believed their new self-managed super fund was ‘safe’ and government regulated - but it was not. The harm of this ‘super switching’ was amplified by large-scale Google and Facebook ads.

In short: Registering your claim ensures you’re on the list to get back whatever money — if any — is recovered. It’s likely that investors come last, after secured creditors like banks and other firms.

do a detailed timeline and find all the financial firms you can complain to

Every investor or victim may have a range of different entities or trusted firms that led them (or misled them) into swapping their superannuation into the Shield or First Guardian funds.

Macquarie, Netwealth, Diversa and Equity are all large well-funded trustees who oversaw Shield and First Guardian.

There were also financial services groups like Praemium, United Global Capital and Interprac as well as ‘new generation’ super platforms with brand names like:

YourChoice Super

Australian Practical Superannuation

Macquarie Wrap

NQ Super (New Quantum)

Super Simplifier

A raft of licensed Financial Advisors with trading names like Venture Egg Financial Services, United Financial Advice, Financial Services Group Australia, Empire Wealth Group, MWL Financial Services, Rebellis and more.

Affected people must raise what’s called an “internal dispute resolution” (IDR) complaint directly with the financial entities that led you to make the fateful decision to invest.

Some of these firms are now in liquidation, which means there are time pressures to lodge complaints.

There are rules for IDR and you need to complain about financial firms that are member firms of the Australian Financial Complaints Authority (AFCA).

Financial Advice Association CEO Sarah Abood says investors should lodge Australian Financial Complaints Authority (AFCA) complaints not just against all financial firms, including platform providers (YourChoice Super, Australian Practical Superannuation, Praemium Super, NQ Super, Freedom of Choice and Super Simplifier), auditors BDO and Auditeo and potentially research houses (Morningstar and SQM), digital marketers, and call centres who played a role funnelling money into the schemes. Not all of these organisations are member firms of AFCA, though.

It’s free to complain to AFCA, but you’ll need to Include as much documentation as possible. We recommend recreating a detailed timeline of what happened, listing all dates, corporations, phone calls and emails that you can find, including any former superannuation statements, cash management account statements and other details.

Read the ASIC page for Shield fund investors and the ASIC page for First Guardian investors.

Read the Diversa trustees page for First Guardian investors.

Read the Equity Trustees page for First Guardian investors and the Equity Trustees page for Shield investors.

UPDATE: Google ‘SOS Save our Super’ to find an action group website with up to date information. They run a free Facebook group too (though you do not need to pay money to participate or contribute to their fundraising - that’s an optional choice).

In September, AFCA reinstated United Global Capital’s (UGC) membership until 5pm AEST on 31 March 2026.

AFCA is holding a free webinar in October about how to make a claim.

These digital ads lured people to switch their superannuation into funds that have now failed and are in liquidation.

3. be prepared to take your claim to AFCA

Once your internal dispute resolution is ‘answered’, you can take the complaint to AFCA for external dispute resolution (EDR).

This process can be very stressful, and it’s complicated by the many entities and companies involved. You can call AFCA on 1800 931 678 (Free call) and email them at info@afca.org.au to understand more about this process.

It’s very important that if any of the financial firms involved in your superannuation or investment are in liquidation, you must lodge a complaint as quickly as possible.

FAAA CEO Sarah Abood says Australia’s superannuation policies have “created a massive pool of money and we have to make sure its defended against people trying to tap into it for the wrong reasons.”

Sarah recommends complaining against the auditors of Shield (BDO Audit) and First Guardian (Auditeo).

Super Consumers Australia have called on Australia’s well-funded superannuation trustees to refund investors in Shield and First Guardian.

At Scam Victim Alliance, we believe our financial system is broken, with failures at many points of the process that force everyday people to wear the cost while big financial firms and corporations do not.

4. other places to report your loss

At Scam Victim Alliance, we believe all financial frauds should be reported to police as thefts.

Some local police may refuse to take your report, in which case we recommend you speak to your local federal member - whose job is to work for you - to make sure you have recourse.

To find your local MP, search for the elected member that represents the electorate you live in.

We also recommend reporting your loss to Scamwatch to make sure the statistics are counted.

5. Rebuild your super & MENTAL HEALTH

Lifeline and Beyond Blue offer free resources to support you.

We recommend everyone experiencing fraud sees their GP to get a mental health plan and seek counselling, ideally bulk-billed through Medicare. Sometimes charitable organisations and financial counsellors can help refer you to quality counsellors that can support you.

People with certain types of superannuation products qualify for 4 ‘MAP’ sessions with an independent, experienced and qualified psychologist or counsellor. Sessions can be provided face to face, online or by phone and generally run for between 45-55 min. Sessions are available 8:30am to 6:00pm Mon-Friday. More details about MAP services are available here:

• YourChoice Super MAP

• AusPrac Super MAP

• Praemium Super MAP

Members of those funds can contact Starlight to arrange a session using the following details:

• Phone: 1300 855 893

• Email: info@starlightpsychology.com.au

While you may need to spend time trying to recover your money, it will also be important to rebuild your superannuation savings.

Think about starting with MySuper or APRA-regulated funds unless you're getting fully informed, independent financial advice. Self managed super funds are higher risk for most people.

Use the YourSuper comparison tool from the ATO — not random websites — to learn more about superannuation.

Read this Pre-Retirement Game Plan guide to help you understand the basics of superannuation planning.